Director dealings are essentially insider transactions for shares between directors and the companies they work for. These dealings are always made public, and are often considered a good indicator of a company’s future prospects. However, they don’t get nearly as much attention as other company news due to their complex nature. Nonetheless, here I’m breaking down this week’s biggest director dealings from three FTSE firms.

Lloyds

Lloyds (LSE: LLOY) is one of Britain’s biggest financial institutions. It earns the bulk of its revenue from mortgage loans. This week, a large number of director dealings occurred with Lloyds shares going both ways.

- Name: Charlie Nunn

- Position of director: Chief Executive Officer

- Nature of transaction: Free shares

- Date of transaction: 22 June 2022

- Amount purchased: 312,313 @ £0.43

- Total value: £135,843.66

- Name: William Chalmers

- Position of director: Chief Financial Officer

- Nature of transaction: Free shares

- Date of transaction: 22 June 2022

- Amount purchased: 149,910 @ £0.43

- Total value: £65,204.85

- Name: Antonio Lorenzo

- Position of director: Chief Executive Officer (Scottish Widows)

- Nature of transaction: Free shares

- Date of transaction: 22 June 2022

- Amount purchased: 148,661 @ £0.43

- Total value: £64,661.59

- Name: Antonio Lorenzo

- Position of director: Chief Executive Officer (Scottish Widows)

- Nature of transaction: Disposal of shares

- Date of transaction: 22 June 2022

- Amount sold: 150,000 @ £0.44

- Total value: £65,457.30

- Name: Vim Maru

- Position of director: Retail Group Director

- Nature of transaction: Free shares

- Date of transaction: 22 June 2022

- Amount purchased: 148,661 @ £0.43

- Total value: £64,661.59

- Name: David Oldfield

- Position of director: Commercial Banking Group Director

- Nature of transaction: Free shares

- Date of transaction: 22 June 2022

- Amount purchased: 145,746 @ £0.43

- Total value: £63,393.68

- Name: Janet Pope

- Position of director: Chief of Staff and Sustainable Business Group Director

- Nature of transaction: Free shares

- Date of transaction: 22 June 2022

- Amount purchased: 104,104 @ £0.43

- Total value: £45,281.08

- Name: Stephen Shelley

- Position of director: Chief Risk Officer

- Nature of transaction: Free shares

- Date of transaction: 22 June 2022

- Amount purchased: 147,828 @ £0.43

- Total value: £64,299.27

- Name: Andrew Walton

- Position of director: Group Corporate Affairs Director

- Nature of transaction: Free shares

- Date of transaction: 22 June 2022

- Amount purchased: 104,104 @ £0.43

- Total value: £45,281.08

Taylor Wimpey

Taylor Wimpey (LSE: TW) is one of the UK’s biggest residential developers. Both the Taylor Wimpey CEO and Chairman bought a large sum of Taylor Wimpey shares this week. This course of action hopes to shore up investor sentiment amid slowing house price growth.

- Name: Irene Dorner

- Position of director: Chairman

- Nature of transaction: Purchase of shares

- Date of transaction: 22 June 2022

- Amount purchased: 21,750 @ £1.15

- Total value: £25,016.20

- Name: Jennie Daly

- Position of director: Chief Executive Officer

- Nature of transaction: Purchase of shares

- Date of transaction: 22 June 2022

- Amount purchased: 21,509 @ £1.15

- Total value: £24,812.57

Berkeley

Berkeley (LSE: BKG) is another one of Britain’s biggest housebuilders. The FTSE 100 firm reported a decent set of results this week. However, this wasn’t enough, as the Berkeley share price slid downwards. Nonetheless, a large set of director dealings and institutional buying amounted to millions of pounds in Berkeley shares. This should boost investor sentiment in the long-term, despite slowing house price growth.

- Name: William and Jane Jackson

- Position of director: Non-Executive Director and Person Closely Associated to Non-Executive Director

- Nature of transaction: Purchase of shares

- Date of transaction: 22 June 2022

- Amount purchased: 16,148 @ £36.57

- Total value: £590,566.42

- Name: Robert Perrins and Vanessa Perrins as Trustees of the Robert Perrins Discretionary Settlement

- Position of director: Person(s) Closely Associated to Rob Perrins (Berkeley Chief Executive Officer)

- Nature of transaction: Purchase of shares

- Date of transaction: 22 June 2022

- Amount purchased: 50,000 @ £36.57

- Total value: £1,847,644.75

- Name: Michael Dobson

- Position of director: Non-Executive Director

- Nature of transaction: Purchase of shares

- Date of transaction: 22 June 2022

- Amount purchased: 4,000 @ £36.17

- Total value: £144,686.56

- Name: Julia Barker

- Position of director: Person Closely Associated with Glyn Barker (Berkeley Chairman)

- Nature of transaction: Purchase of shares

- Date of transaction: 22 June 2022

- Amount purchased: 1,950 @ £37.27

- Total value: £72,669.37

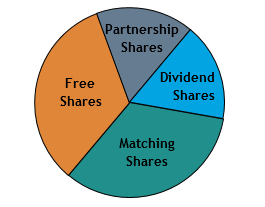

Types of shares in a SIP

To provide context, there are a few types of shares within a company’s share incentive plan (SIP). A SIP is an employee plan for companies within the UK to flexibly award equity to employees. Publicly listed companies normally exercise this option because it’s tax-efficient for both the employer and its employees.

In this instance, most of the director dealings at Lloyds occurred with free shares. These shares were acquired by directors under the Lloyds fixed share award scheme. Share award schemes give employees actual shares rather than share options. The value of shares given to directors here are treated as employment income. This means that they may be subject to tax and national insurance contributions. That is unless they opt for an HMRC-approved share scheme, which has its own rules and requirements.