The Carnival (LSE: CCL) share price has been stagnating around its all-time low level. In fact, its stock has seen a 50% decline this year. But with the travel industry making a comeback, Carnival shares could rally when it reports its Q2 results later this week.

Murky waters

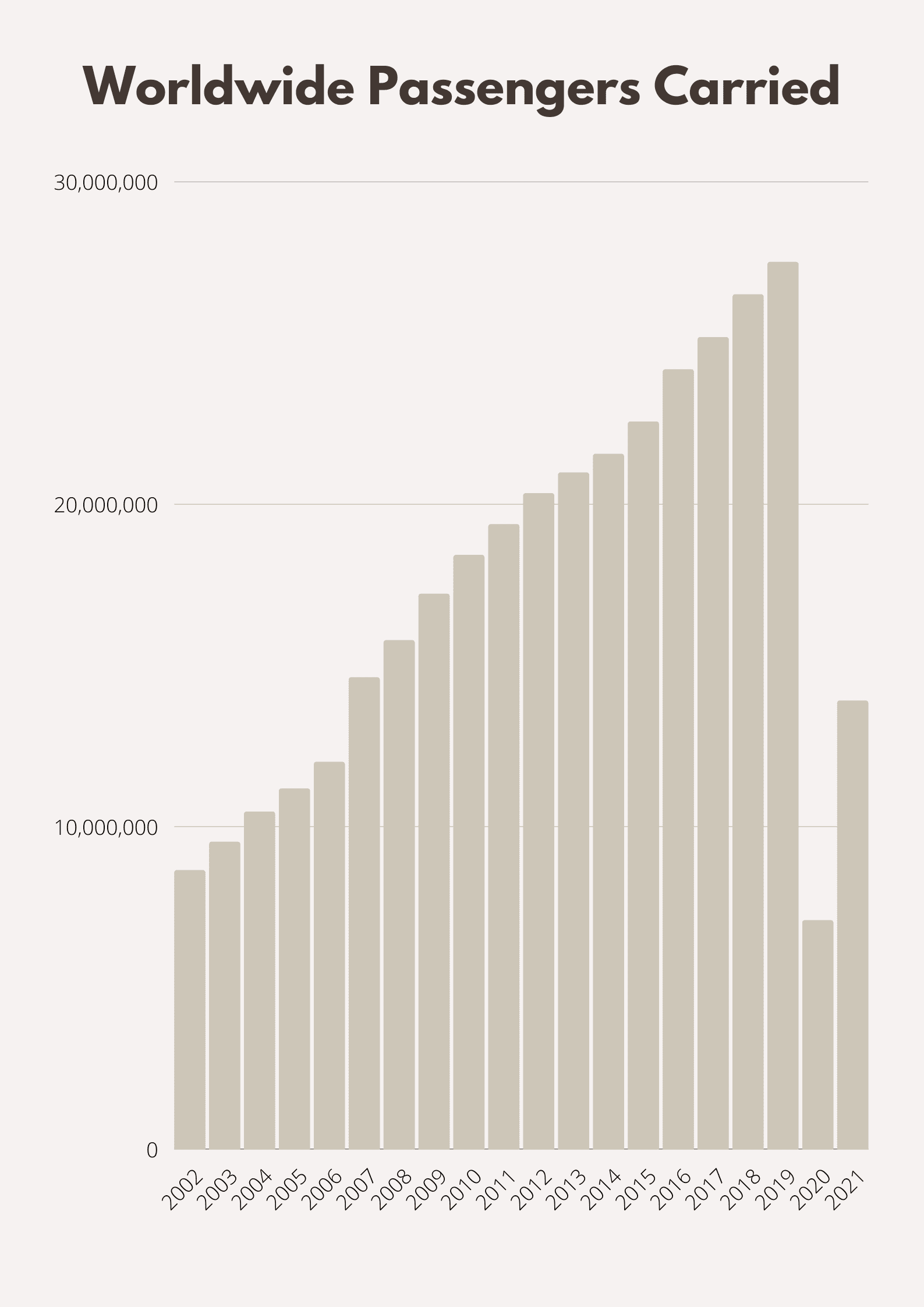

Pre-pandemic, the travel cruise industry was a rather lucrative one to invest in. The top cruise companies enjoyed profit margins of over 10%, and an ever growing market. Consequently, Carnival enjoyed consistent top and bottom line growth throughout the years.

Then came the pandemic, which nearly destroyed the entire cruise ship industry, as passenger numbers plummeted to levels not seen since 2000. Nonetheless, a sharp rebound in 2021 seemed to indicate that travel may be returning with a bang. Even so, a great deal of uncertainty still lies ahead for Carnival.

Is Carnival getting started?

At the end of last week, management announced its plans to release its Q2 earnings later this week. As such, future bookings will be one of the most important metrics I’ll be paying attention to. The majority of Carnival passengers travel to and from the United States. I’m expecting a decent figure, after the US lifted testing requirements last week.

| Location | Passengers Carried (2019) |

|---|---|

| United States and Canada | 7,170,000 |

| Continental Europe | 2,590,000 |

| Asia | 1,110,000 |

| Australia and New Zealand | 920,000 |

| United Kingdom | 780,000 |

| Other | 300,000 |

If a stronger than expected bookings number is reported, I envision the Carnival share price to rebound. On the flip side, a much weaker than expected number could be the nail in the coffin for the FTSE 250 firm. Nevertheless, Carnival shares are up 8% on Monday as investors gear up for the much anticipated report.

That being said, although Covid variants have taken a backseat, another mutation could send the travel industry into another decline. Additionally, persistent economic headwinds are expected to hinder passenger growth in the coming quarters. High oil prices, roaring inflation, and ever increasing interest rates have consumer sentiment pointing towards a recession. These worries were echoed recently by a Morgan Stanley analyst who predicts lacklustre sales for the cruise ship company.

A sinking ship?

Despite the potential upbeat numbers, there’s one thing I can’t ignore about Carnival, and that’s its soaring levels of debt. The company only has $7bn in cash and equivalents, and almost $36bn of debt to repay. While its near-term repayments aren’t too hefty, the figure only gets exponentially higher from here on out.

| Year | Principal Payments |

|---|---|

| Q2 2022 | $182m |

| Q3 2022 | $409m |

| Q4 2022 | $982m |

| 2023 | $2,898m |

| 2024 | $4,825m |

| 2025 | $4,522m |

| 2026 | $4,598m |

| Thereafter | $17,304m |

| Total | $35,721m |

With the increasing amount of repayments, the firm will have to hope that the industry rebounds sharply and quickly to generate enough cash. Otherwise, I foresee the board issuing stock to raise cash, thus sending the Carnival share price even lower. The alternative would be to refinance its debt, but doing so risks taking on higher interest rates, and a higher total repayment value.

If historic demands returns, Carnival shares may just make one of the biggest comebacks. However, that remains a slim possibility given the current economic landscape. Not to mention, a Bloomburg analyst even red flagged Carnival’s ability to meet repayments. Therefore, I’m doubtful that the Carnival share price can recover from these levels for the foreseeable future. So, I won’t be investing in Carnival shares. Instead, I’ll be investing in other growth stocks that have better financials.