Since the company’s initial public offering, the Deliveroo (LSE: ROO) share price has plummeted by more than 70%. The shares are currently trading for less than £1, which makes me wonder whether they can recover from these levels.

Deliveroo results

Despite reporting a decent set of Q1 results, the Deliveroo share price continues to fall. Orders, gross transaction value (GTV), monthly active customers (MAC), and average monthly order frequency all saw healthy increases. And although GTV per order saw a decline, this was attributed to the artificial spike from the pandemic, as the figure actually returned to pre-pandemic levels.

| Deliveroo Metrics for Q1 | 2021 | 2022 |

|---|---|---|

| Orders | 70m | 82m |

| GTV | £1,616m | £1,787m |

| GTV per Order | £23.20 | £21.70 |

| MAC | 7.1m | 8.1m |

| Average Monthly Order Frequency | 3.3 | 3.4 |

Based on the data, it seems to me that Deliveroo’s business is more volume-based than quality-based. As such, its focus will be to recruit more customers, rather than getting customers to spend more per order.

Hopping to great heights

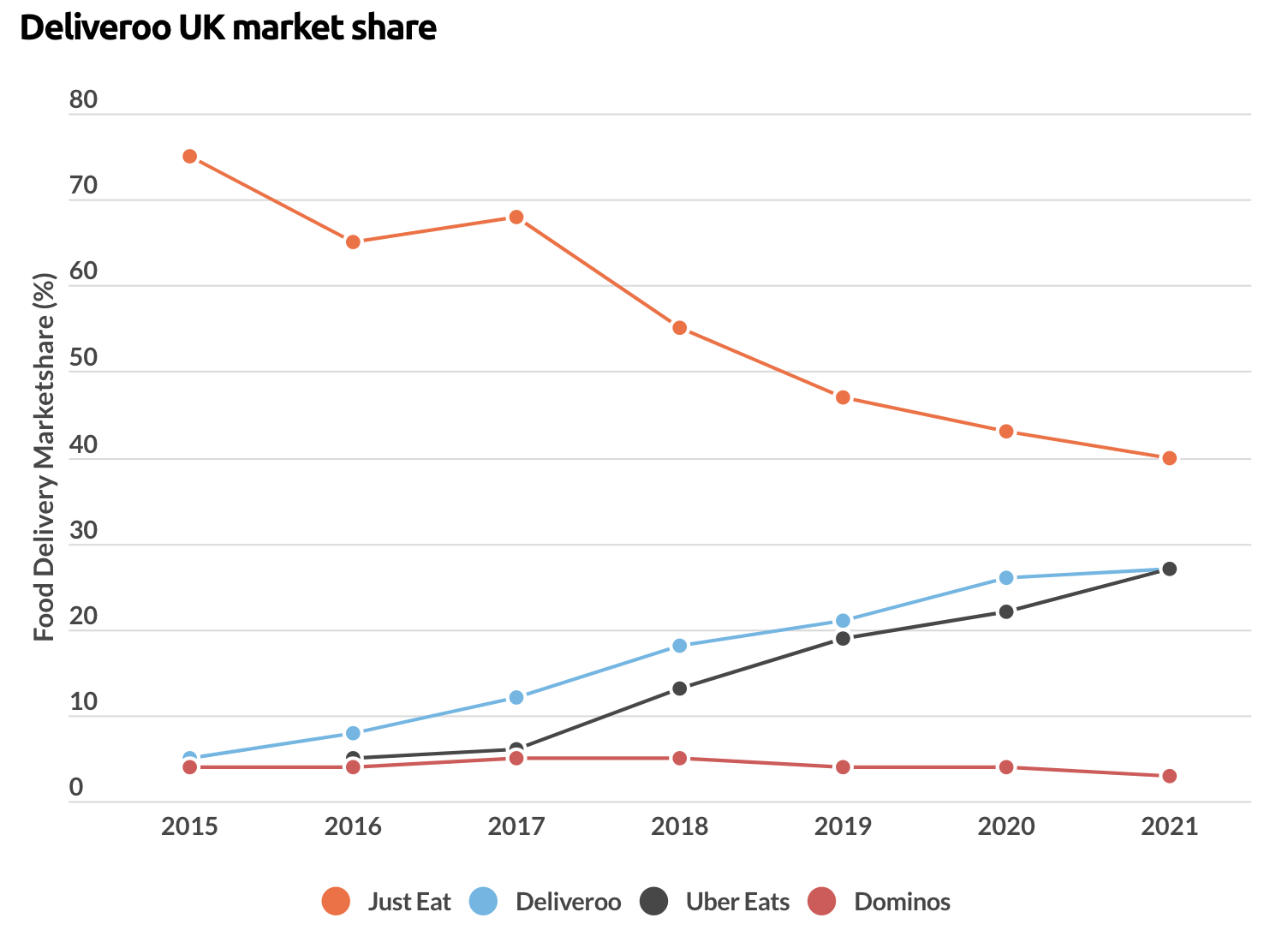

Since 2015, Deliveroo’s UK market share has grown to an impressive 22% from 5%. The food delivery service has managed to continue snatching market share away from its biggest competitor, Just Eat, and looks towards possibly overtaking in the future.

One of the main reasons for Deliveroo’s aggressive growth has been its key partnerships. In the last year, it has partnered with the likes of WH Smith, Sainsbury’s, Waitrose, Morrisons, and Carrefour. These partnerships have allowed the firm to deliver fresh groceries and even appliances, thus expanding its product offering.

Not to mention, its strategic collaboration with Amazon has provided a surge of new customers. Amazon Prime users are eligible for free Deliveroo Plus perks, such as free delivery. As a result, Deliveroo saw its MAC increase by a million over the last year.

More excitingly, the firm recently announced a new partnership with McDonald’s, with a roll out expected in Q2 2022. Given that McDonald’s contributed to over 60% of Uber Eats’ sales in 2020, I have no doubt that the fast food chain is going to boost Deliveroo’s top line.

Cash-rich pouch

All that being said, Deliveroo has got to buckle up. The company no longer enjoys pandemic tailwinds as workers return to the office, and inflation continues to run rampant. Real wages are continuing to decline and a recession is being pencilled in for later this year.

Fortunately, Deliveroo sits on a large pile of cash at £1.3bn with zero debt. It only burnt through £224m in 2021, giving it a cash runway of about 5.8 years. Given that management expects to achieve breakeven on an adjusted EBITDA margin by 2024, this shouldn’t be a problem. However, a potential recession could push its timeline backwards and sour investor sentiment even further.

Although Deliveroo expects to be profitable by 2026, a 6% EBITDA margin is rather slim. Moreover, it faces tough competition from Uber Eats, which recently launched its own free delivery subscription to compete with Deliveroo Plus.

Analysts aren’t forecasting Deliveroo to be profitable within the next three years either. Therefore, I’m not expecting the Deliveroo share price to recover from penny stock levels any time soon. So, even though Deliveroo’s partnerships bring exciting times ahead, I’m not a fan of its low-margin business model, nor its shares for the time being.