Director dealings are essentially insider transactions for shares between directors and the companies they work for. These dealings are always made public, and are often considered a good indicator of a company’s future prospects. However, they don’t get nearly as much attention as other company news due to their complex nature. Nonetheless, here I’m breaking down this week’s biggest director dealings from three FTSE firms.

Dunelm

Dunelm (LSE: DNLM) is a British home furnishings retailer that operates throughout the UK. It is one of the largest homewares retailers in the country with an ever growing market share. New director Karen Witts was appointed CFO this week and a number of Dunelm shares were awarded to her.

- Name: Karen Witts

- Position of director: Chief Financial Officer

- Nature of transaction: Free shares

- Date of transaction: 9 June 2022

- Amount purchased: 73,979 @ nil

- Total value: £N/A

Investec

Investec (LSE: INVP) is an international banking and wealth management group. It provides a range of financial products and services to a clients in Europe, Southern Africa and Asia Pacific. This week, a number of director dealings were carried out in both directions.

Should you invest £1,000 in Barclays right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barclays made the list?

- Name: Ciaran Whelan

- Position of director: Director

- Nature of transaction: Sale to cover tax liabilities

- Date of transaction: 8 June 2022

- Amount sold: 24,037 @ £4.77

- Total value: £114,674.28

- Name: Ciaran Whelan

- Position of director: Director

- Nature of transaction: Partnership shares

- Date of transaction: 8 June 2022

- Amount purchased: 21,531 @ £4.77

- Total value: £102,702.87

- Name: Stephen Koseff

- Position of director: Director

- Nature of transaction: Sale to cover tax liabilities

- Date of transaction: 6 June 2022

- Amount sold: 31,514 @ £4.82

- Total value: £151,938.67

- Name: Ruth Leas

- Position of director: PDMR

- Nature of transaction: Sale to cover tax liabilities

- Date of transaction: 8 June 2022

- Amount sold: 10,179 @ £4.75

- Total value: £48,374.68

- Name: Ruth Leas

- Position of director: PDMR

- Nature of transaction: Partnership shares

- Date of transaction: 8 June 2022

- Amount purchased: 10,330 @ £4.75

- Total value: £49,092.29

- Name: Fani Titi

- Position of director: Director

- Nature of transaction: Sale to cover tax liabilities

- Date of transaction: 6 June 2022

- Amount sold: 75,150 @ £4.84

- Total value: £363,996.54

- Name: Nishlan Samujh

- Position of director: Director

- Nature of transaction: Sale to cover tax liabilities

- Date of transaction: 6 June 2022

- Amount sold: 37,885 @ £4.84

- Total value: £183,499.79

Bodycote

Bodycote (LSE: BOY) is the world’s largest provider of heat treatment and thermal processing services. The service acts as a vital link in the manufacturing supply. A non-executive director purchased a decent number of Bodycote shares this week.

- Name: Nicola Susan Boyd

- Position of director: Director

- Nature of transaction: Purchase of shares

- Date of transaction: 8 June 2022

- Amount sold: 3,000 @ £6.54

- Total value: £19,620.00

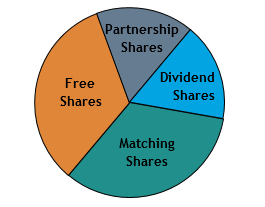

Types of shares in a SIP

To provide context, there are a few types of shares within a company’s share incentive plan (SIP). A SIP is an employee plan for companies within the UK to flexibly award equity to employees. Publicly listed companies normally exercise this option because it’s tax-efficient for both the employer and its employees.

In this instance, the director dealings at Investec bought partnership shares. Employees can use a SIP to buy shares on a monthly basis or at the end of an ‘accumulation period’. If there is an accumulation period in effect, employees can buy shares at the market value at the beginning or end of the period.