Scottish Mortgage Investment Trust (LSE: SMT) is one of the world’s biggest investment trusts. The share price is down 35% this year, following US indices into bear market territory. However, positive economic data released last week made its share price jump by 15%. As such, the trust may be set for a turnaround.

Declines are difficult to bear

Seeing a company’s share price plunge deep into the red is never a pretty sight. Unfortunately, the trust’s investors had to bear with losses of up to 45% at one point. So, what’s behind the monumental drop in share price? Well, the Scottish Mortgage portfolio holds an abundance of growth names. The top 10 holdings alone have an average price-to-earnings (P/E) ratio of 37, which is more than twice the S&P 500‘s P/E ratio of 16.

| Scottish Mortgage Investment Trust Holdings | Fund % |

|---|---|

| Moderna | 6.5% |

| ASML | 6.4% |

| Illumina | 6.3% |

| Tesla | 6.2% |

| Tencent | 4.9% |

| Meituan | 3.0% |

| NVIDIA | 2.7% |

| Amazon | 2.6% |

| Alibaba | 2.6% |

| Kering | 2.4% |

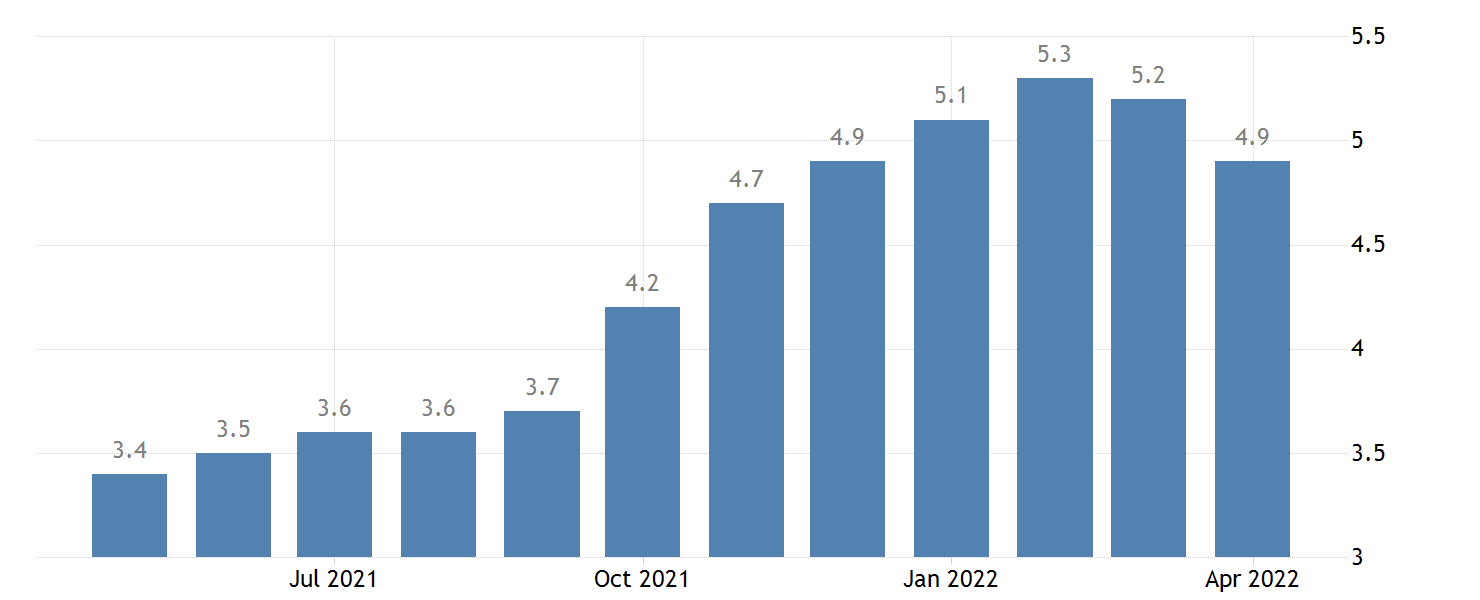

Growth stocks suffer the most when interest rates rise, as has been the case due to sky-high inflation. As a result, spending is expected to decrease due to higher borrowing costs. As growth stocks get their valuations from future cash flows, a slowdown in future spending slashes their valuations.

To make matters worse, China’s zero-Covid policy has led to several lockdowns in big cities. These lockdowns have had an impact on several of the FTSE 100 trust’s top Chinese holdings. Consequently, the Scottish Mortgage share price has suffered a decline from its biggest investments.

Trust and hope

That being said, Scottish Mortgage saw its share price rebound last week. This was down to a generally positive set of US economic data. Consumer spending figures were rather upbeat, and minutes released from the Fed meeting eased fears of a 0.75% rate hike. But most importantly, the core price consumption expenditure (PCE), the Fed’s preferred index for measuring inflation, pointed towards inflation peaking in April. This led to one Fed official suggesting that the central bank could even pause rate hikes in September. Officials from China also mentioned plans of lifting lockdowns which sent many of the portfolio’s Chinese stocks rallying, positively impacting SMT shares.

Unstable foundations

While Scottish Mortgage shares present a tremendous amount of upside, it also comes with plenty of risks. Since its remarkable one-week recovery, oil prices have shot back up to the $120 per barrel mark. Given that the main cause of inflation has been high oil prices, an EU ban on Russian oil imports, along with the reopening of the Chinese economy, isn’t going to drive inflation down anytime soon.

Moreover, although China has began lifting its lockdowns, there’s no certainty that a similar episode won’t happen again in the future. Therefore, I’m doubtful that the fund is completely out of the woods for a turnaround. The Chinese government’s ability to manipulate share prices of its local companies also presents too big of a risk to me. Thus, I won’t be looking to invest in SMT shares anytime soon. Instead, I’ll be looking to purchase other shares that could benefit my portfolio with more stability.