Investors who bought NIO (NYSE: NIO) at the start of the 2020 stock market crash would be sitting on a healthy profit right now. In fact, the NIO share price dropped to under $3 in March 2020, yet currently sits at just under $17. However, the same cannot be said for investors who bought NIO before the recent technology sell-off. In the past year, NIO stock has plunged around 55%. As such, after this fall, is NIO the best EV stock for me to buy right now?

Why has NIO stock fallen so much?

There are multiple macroeconomic pressures for growth stocks at the moment. Principally, these include high rates of inflation and rising interest rates. High inflation lowers the value of future cash flows, which is where growth stocks such as NIO gain their large valuations. Higher interest rates are also a major negative because it makes it more expensive to borrow money for growth.

There are several specific issues for NIO as well. Firstly, the recent Shanghai lockdown has caused major supply chain disruption, forcing the company to suspend production of its cars at the start of April. This may have negative effects on this year’s revenues. Further, due to its Chinese connections, the EV firm has been placed on the US SEC’s list of companies that may be delisted. This would deprive the company of a significant source of funding and result in a smaller pool of investors to buy.

Has the sell-off been overdone?

Although these are all very legitimate risks, there are still many positives with NIO stock. For example, in 2021, the company managed to grow revenues by 122% to reach nearly $5.7bn. It also ended the year with $8.7bn in cash, and should be able to absorb the losses currently being recorded.

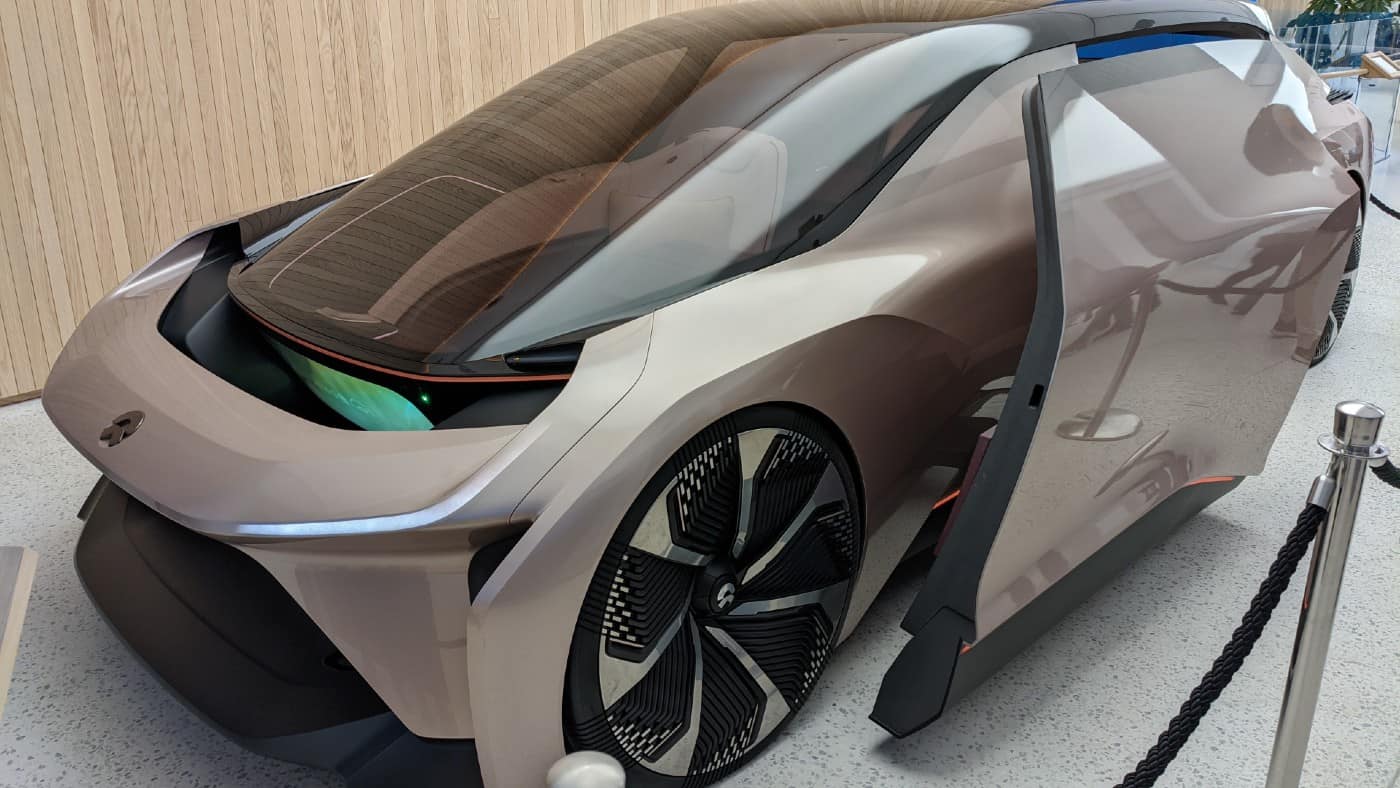

There are also signs that revenues may be able to grow in the next few years. For example, the company has recently launched the ET5 model, with deliveries expected to start in September. It’s also planning to build a plant in Hefei, China, and this could start production by 2024. This would hopefully lead to further growth.

Finally, NIO has recently undergone secondary listings in both Hong Kong and Singapore. These should be able to mitigate the impact of delisting threats from the US.

Is NIO the best EV share around?

There’s a great deal of competition in the EV sector. For many, Tesla remains the best buy out there. However, even after its recent sell-off, Tesla still trades on a price-to-sales ratio of over 10, whereas NIO’s P/S ratio is just 4.5. Further, Tesla is considered likely to start losing EV market share in the US, a factor which may have long-term consequences. Therefore, I prefer NIO to Tesla.

However, there’s also competition in China, with a major peer being XPeng. Although XPeng trades at a slightly higher P/S of 6, it also managed to grow revenues by 260% year-on-year in 2021. And it expects better growth than NIO moving forwards. Therefore, in my opinion, XPeng is the best EV share around right now. Even so, NIO does remain cheap, and I’d still be tempted to open a small position for my portfolio, as well as one in XPeng.