Director dealings are essentially insider transactions for shares between directors and the companies they work for. These dealings are always made public, and are often considered a good indicator of a company’s future prospects. However, they don’t get nearly as much attention as company news due to their complex nature. Nonetheless, here I’m breaking down this week’s director dealings for three of the FTSE 100‘s top firms.

HSBC

The HSBC share price has had a volatile time so far this year. The stock jumped nearly as high as 25% only to drop back down to a 5% gain this year. This has been mainly down to speculation of the bank having to break up its Asian and western operations. Amid all of the volatility however, it still didn’t stop a director from acquiring shares this week.

Dame Carolyn Fairbairn (The former CBI Director General) purchased a large number of HSBC shares on Wednesday.

Should you invest £1,000 in HSBC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if HSBC made the list?

- Name: Dame Carolyn Fairbairn (Non-executive Director)

- Nature of transaction: Acquisition of shares

- Date of transaction: 18 May 2022

- Amount purchased: 15,000 @ £5.01

- Total value: £75,150.00

National Grid

National Grid disclosed its FY22 results this week. The energy company reported an underlying operating profit of £4.0bn, which is 11% higher year on year. The firm also announced a final dividend of 33.76p, bringing the total dividend to 50.97p. This is a 3.7% increase in its yield. As a result, the National Grid share price is now up by more than 10% this year, sparking interest by a director in buying shares.

There’s still plenty of worry in the air. Talk of a possible windfall tax on energy companies has hindered the stock’s trajectory upwards. Nonetheless, a non-executive director still saw this is an opportunity to buy National Grid shares on Thursday.

- Name: Victoria Wood (CAP of Tony Wood, Non-executive Director)

- Nature of transaction: Acquisition of shares

- Date of transaction: 19 May 2022

- Amount purchased: 2,000 @ £12.29

- Total value: £24,586.60

Taylor Wimpey

Housebuilding giant Taylor Wimpey had a relatively decent week. Its shares managed to outperform the wider FTSE 100 index as it gained over 2%. Its stock is still down by more than 25% this year, but a number of director dealings are still happening inside the company, suggesting confidence that it has a bright future in the long term.

Although higher mortgage rates are expected to cool the housing market, Taylor Wimpey said: “Demand for our homes remains strong, with the business well positioned to deliver further progress in 2022 and beyond” in its most recent trading update. As such, a number of directors added more shares to their portfolio.

- Name: Jennie Daly (CEO)

- Nature of transaction: DRIP shares

- Date of transaction: 13 May 2022 (Reported 17 May 2022)

- Amount purchased: 5,815 @ £1.25

- Total value: £7,260.42

- Name: Chris Carney (Group Finance Director)

- Nature of transaction: DRIP shares

- Date of transaction: 13 May 2022 (Reported 17 May 2022)

- Amount purchased: 6,513 @ £1.25

- Total value: £8,131.92

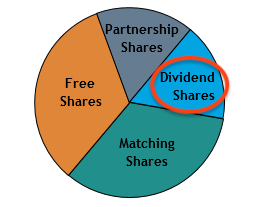

To provide context, DRIP shares are usually part of a company’s share incentive plan (SIP). A SIP is an employee plan for companies within the UK to award equity to employees flexibly. Publicly listed companies normally exercise this option because it’s tax-efficient for both the employer and its employees.

There are many types of shares in an SIP. But in this instance, the CEO and Group Finance Director used the dividends they received on SIP shares to reinvest into further Taylor Wimpey shares. It should be noted though, that dividend shares must normally be held in the trust for at least three years to get full tax relief.