Already 30% down this year, Royal Mail (LSE: RMG) stock has continued sinking. The FTSE 250 constituent released its FY22 results today. With many declines in key metrics and a gloomy outlook, the Royal Mail share price could be in for a tough time.

Posting disappointing numbers

A disappointing set of numbers sent the Royal Mail share price 10% down. While the group’s total revenue increased by 0.6%, it was below what analysts were expecting at £12.8bn. It’s also worth noting that revenue for the Royal Mail unit actually saw a decline. Its subsidiary GLS had an excellent year and was the sole reason behind the group’s total revenue growth. Earnings per share (EPS) dropped too, and total parcels volume saw a decline as well, falling 13%. Making matters worse, its balance sheet also took a hit. The board is lowering its dividend from 20p to 13.3p. Nonetheless, its financial position is much better than it was pre-pandemic.

| Royal Mail Group Metrics for FY22 | 2022 | 2021 | 2020 |

|---|---|---|---|

| Total Parcel Volume (Millions) | 1,517 | 1,735 | 1,312 |

| Group Revenue (£m) | 12,712 | 12,638 | 10,840 |

| Group Operating Profit (£m) | 577 | 611 | 55 |

| EPS | 61.7p | 62.0p | 16.1p |

| Net Debt (£m) | 985 | 457 | 1,132 |

| Net Cash (£m) | 307 | 622 | -46 |

Issues to address

With Royal Mail yet to agree a pay deal with its workers, uncertainty for the company looms. A strike is a possibility and could hit the top line even further. But if a pay deal is struck, management expects operating margins to stay healthy for the year. However, guidance was largely negative as Royal Mail continues to expect a decline in parcels volume. The winding down of Covid testing, with kits constituting 7% of parcels volume, is expected to hit the top line. Moreover, inflationary pressures have put a dent in international parcels and letter volumes. CFO Mick Jeavons mentioned on the earnings call that international parcels generate accretive margins, and Royal Mail is looking to revive its overseas shipments. Having said that, a potential recession meant the board gave no expected revenue or parcel figures for the year.

Positives to weigh in

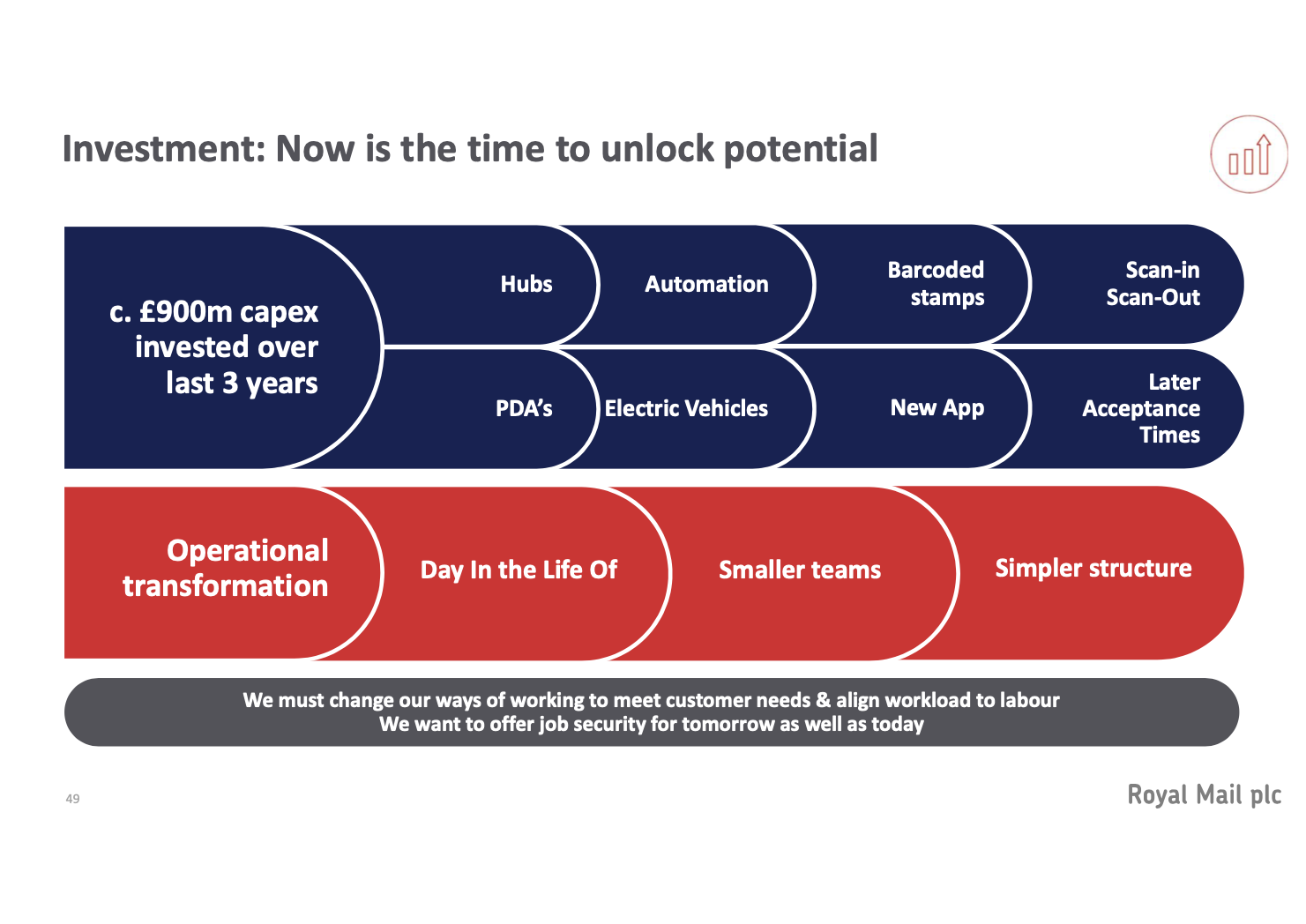

Yet among the doom and gloom, there were a couple of positives to take away. For one, Royal Mail managed to gain market share (Excluding Covid test kits). It also heavily invested in a number of initiatives to boost parcels volume and reduce operating costs. These include Sunday deliveries, parcel collect, Royal Mail Health, barcoded stamps, and increased automation.

GLS is also expected to continue growing and expanding, which is good news given that the division generates half of group profits. Royal Mail CEO Simon Thompson was also upbeat about resolving the company’s dispute with its workers. He cited a 75% decrease in disputes from workers, a positive indication that a pay deal may follow. He also mentioned that Royal Mail is well positioned to increase prices by 4% on average, as the brand has strong pricing power. More importantly, the board expects parcel volumes to stabilise slightly above pre-pandemic levels in 2024, which is a good sign.

Nevertheless, I still believe that uncertain times lie ahead for the Royal Mail share price. With a negative outlook and a business that’s heavily reliant on macroeconomic factors, this isn’t a stock I’m looking to invest in for long term growth.