It’s no secret that sky-high inflation has driven consumer confidence down to levels not seen since 2008. Last week, the Bank of England followed the US Federal Reserve with an additional interest rate rise. This sent stock markets into the red. With fears of an impending recession, here are three of my best tips on how to invest in today’s stock market.

Golden opportunity?

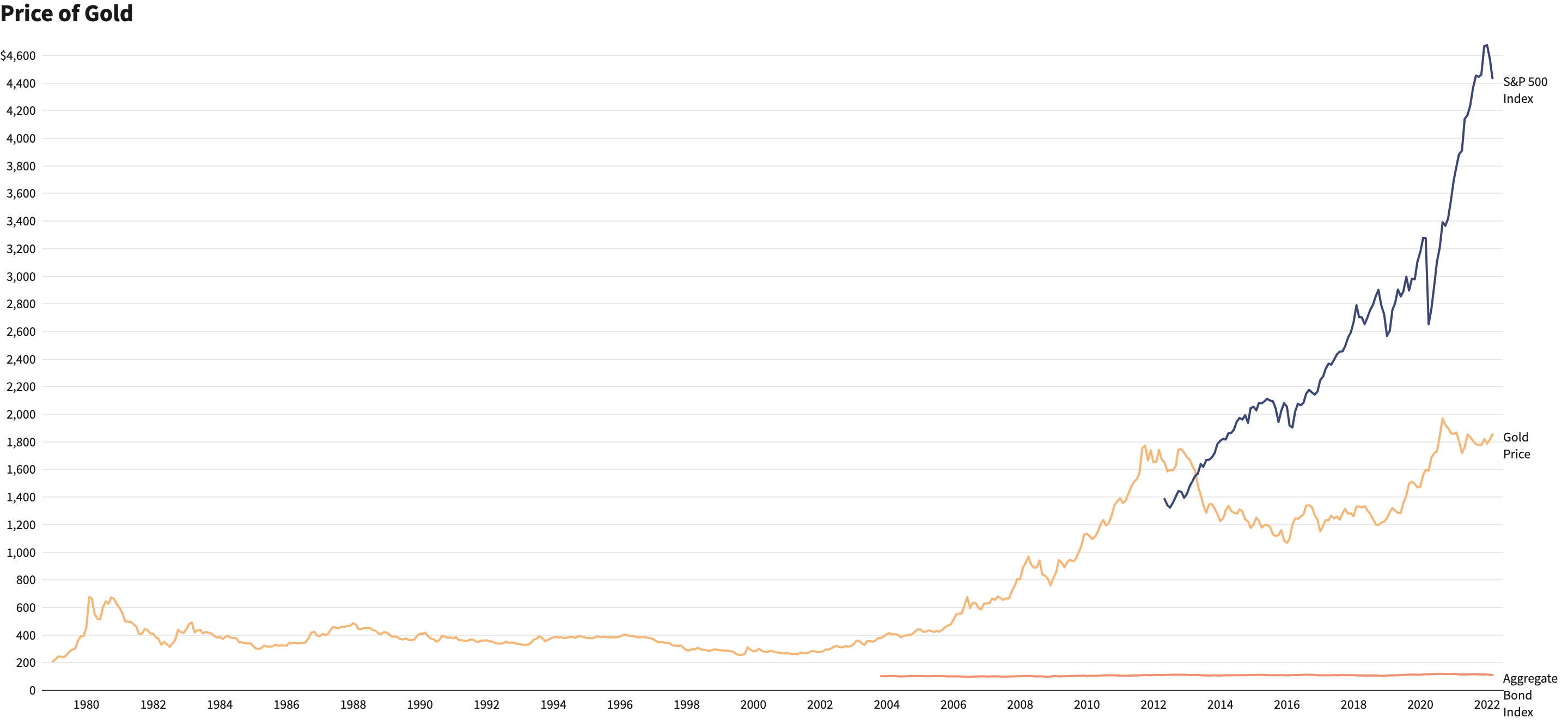

Given the wild swings for stocks and lower cash value from high inflation, the casual observer might have expected gold to do well. On the contrary, this week saw gold trade at its worst levels since February. This was due to the strength of the US dollar, as it hit a 20-year high, rebuffing views that the greenback is a dying dinosaur. While both gold and cash offer more safety than equities, gold has underperformed the stock market over most time periods. As such, I feel the golden opportunity isn’t investing in gold, but rather in the stock market over the long term.

There’s been lots of noise but no real direction as to whether the falls are a great buying opportunity, or just the first step in a much more serious bear market. If inflation remains high, further rate rises look inevitable. This is bad news for property, equities, and bonds, especially if paired with an economic downturn. Despite that, it’s worth noting that although the stock market seeing plenty of red lately, history’s on its side. Since its inception, the US S&P 500 has rebounded from every single market crash, for instance.

Time in the market is better than timing the market

Many investors seek to time the market by finding a bottom before investing. Unfortunately, it’s very rare that this actually works. The best-known investor globally, Warren Buffett, once said: “I haven’t the faintest idea what the stock market is going to do when it opens on Monday.” More often than not, investors have to suffer a little bit of pain before seeing a return on investment. Be that as it may, being patient is easier said than done. It’s never easy investing your savings only to watch them lose half their value. Hence why it’s crucial to pick the right stocks.

Picking the right stocks

That brings me on to how to do that. Do your due diligence — that’s the most important thing before investing in the stock market. Like the oracle of Omaha, I follow a strict checklist before purchasing stocks. I look for:

- Solid fundamentals (Low debt and healthy cash levels).

- A company with pricing power or high margins.

- Great earnings potential.

These qualities sound simple, but they’re more difficult to find in many companies than not. Nonetheless, one such company that exhibits all these traits is Google owner, Alphabet. The mega-cap boasts an excellent balance sheet, healthy margins (30%), and great earnings potential through the development of its many offerings. Nevertheless, its share price is down 20% this year as the firm came in short of earnings expectations and future underperformance remains a risk. However, I’ll be capitalising on its lower price to add to my Alphabet position.