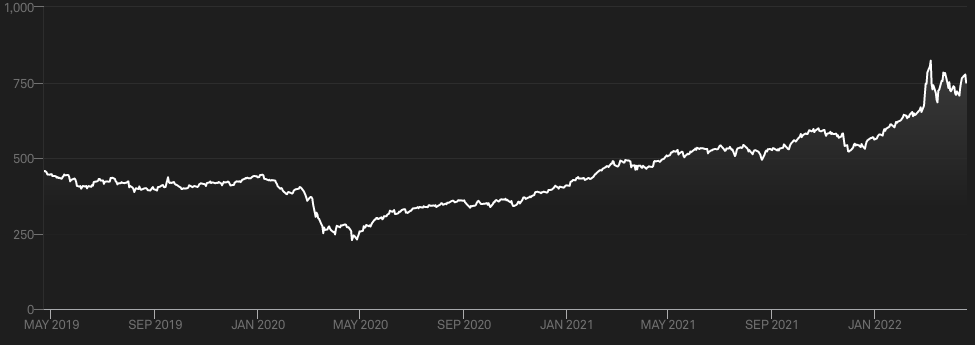

Anglo American (LSE:AAL) stock has been a standout performer in my portfolio in 2022, rising about 27% year to date. The metals and mining giant has benefitted from commodity price inflation due to supply constraints in the face of increasing demand. Given that commodity prices have been ticking higher for some time according to the S&P GSCI commodity index, today’s 9% slump in the Anglo American share price caught me off guard.

Figure 1. The S&P GSCI commodity index from May 2019 to now

Yesterday the International Monetary Fund (IMF) cut its global growth forecast for this year to 3.6%. For reasons, it offered risks from the situation in Ukraine, tightening fiscal and monetary policy, and ongoing Covid-19-related drags on economic activity. That might be expected to hurt Anglo Americans’ share price. But, the IMF also warned of prices, which would include commodities, rising 7.4% this year, which should be good for the Anglo American share price.

It’s all about mining output

The IMF’s report came out yesterday. Anglo America shares dipped but not by much. Today’s slide is all about lowered output guidance. According to the company, its first-quarter 2022 production fell 10% year on year. The cause was cited as worker absences due to Covid-19, high rainfall affecting Brazilian and South African operations, and other operational challenges. Not all product lines suffered equally. Rough diamond production increased by 25% in Q1, and full-year guidance remained unchanged. Copper production fell 13%, but full-year guidance remains unchanged. Iron ore and platinum group metal production fell by 19% and 6%, respectively, and full-year guidance decreased. That is concerning, as these product lines accounted for 26% and 34% of group revenues last year.

Table 1. Selected Anglo American Q1 2022 production and full-year guidance for various products selected on their total revenue share

| Product | Q1 2022 production increase/(decrease) | Full-year guidance (previous guidance) | Share of 2021 group revenue |

| Rough diamond | 25% | 30-33m carats (30-33m carats) | 13% |

| Platinum group metals | (6%) | 3.9-4.3m ounces (4.1-4.5m ounces) | 34% |

| Copper | (13%) | 660-750 kilo tonnes (660-750 kilo tonnes) | 15% |

| Iron ore | (19%) | 60-64m tonnes (63-67m tonnes) | 26% |

| Metallurgical coal | (32%) | 17-19m tonnes (20-22m tonnes) | 7% |

Another point of concern in the report was that cost of production has been increasing. Of course, increasing the prices of the items, in this case, metals and ores, a company is selling is a good thing. But, if the input prices for raw materials and energy are also increasing, then benefits from increased sales prices can be offset.

Anglo American share price

Those Covid-19 absences won’t go on forever. Disruptive weather is unpredictable, although it will become more frequent if climate change continues. That being said, rainy seasons don’t last all year. But overall, these are temporary blips and are unlikely to persist for multiple quarters.

But, Anglo American is and always has been a cyclical stock. When economic growth is improving, the Anglo American stock price goes up, and it falls when things take a turn for the worse. With all the risks to global growth and those inflationary fears, I would not call myself an Anglo American bull. But, I am not going to be selling now. I bought this stock for its dividends. My expected dividend yield is still enticing enough to suffer through a much larger slump than today.