After a rollercoaster ride featuring more thrills and spills than the movies it shows, the Cineworld (LSE: CINE) share price is now back to pretty much where it stood at the beginning of 2022. Time to get optimistic about a sustained recovery? Quite the opposite, in my opinion.

Horror show

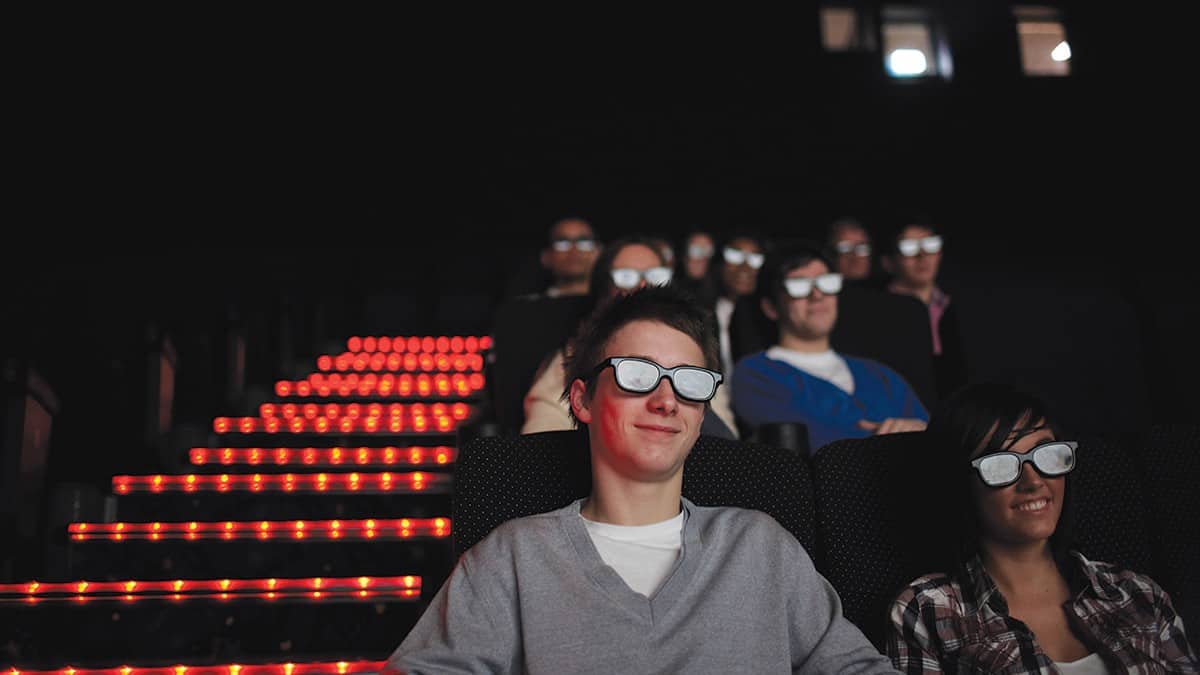

Cineworld’s woes are well known. A victim of the pandemic, the company was forced to shut all sites as UK lockdowns kicked in. Once re-opened, there simply weren’t enough new movies for stoical mask-wearing visitors to see due to delays in production. Revenues duly tanked.

And then there’s the firm’s precarious financial position. After pursuing and then abandoning an ambitious growth strategy, Cineworld landed itself in hot water. It backed out of a deal with Canadian rival Cineplex, leading the latter to seek damages. Cineplex won and the UK-based company now faces a fight just to stay in business. No wonder the business is currently the most shorted share on the London Stock Exchange.

For me however, there’s another very simple reason why I struggle to see the Cineworld share price ever truly recovering. Actually, it can be summed up in two words: ‘The Batman’. Not what you were expecting? Let me explain.

Holy smokes, Cineworld!

Being a fan of the caped crusader, I always had it in mind to see the latest incarnation (released on 4 March) at my local Cineworld. For whatever reason, time’s got away from me. It was dropped from the schedule last week.

But here’s the problem that even Bruce Wayne’s billions can’t fix. The very same film is due for release on streaming services as soon as 19 April. That’s less than a week away!

Forget the legal wrangling — this quicker-than-usual turnaround is reason enough for me to suspect that Cineworld can’t bounce back. Unless I’m an avid fan of a particular genre or character or series, how motivated will I be to visit one of its sites?

I can simply rent the film from the comfort of my home only a few weeks later for the price of a single ticket. And if I wasn’t bothered about watching it immediately, I know it will be available to view as part of my streaming subscription, eventually.

Sure, the rise and rise of streaming services is old news. However, the huge rise in the cost of living we’ve seen in 2022 is surely only going to increase pressure on a company like Cineworld at the worst possible time. From a value-for-money perspective, it just can’t compete.

I could be wrong

Naturally, nothing is certain when it comes to the stock market. While I remain very bearish on Cineworld’s prospects, there’s always a chance it might carry on. The slate of films scheduled for release in the remainder of 2022 certainly doesn’t look bad. These include Top Gun: Maverick and Jurassic World: Dominion. We could see a rise as the short-sellers rush to close their positions if trading turns out to be even slightly better than expected.

But I’m an investor, not a trader. Adopting a Foolish mentality means I’m only really looking for great stocks to own for years. The rapidly shortened window of opportunity for Cineworld to make money makes me think it’s unlikely to be in contention.