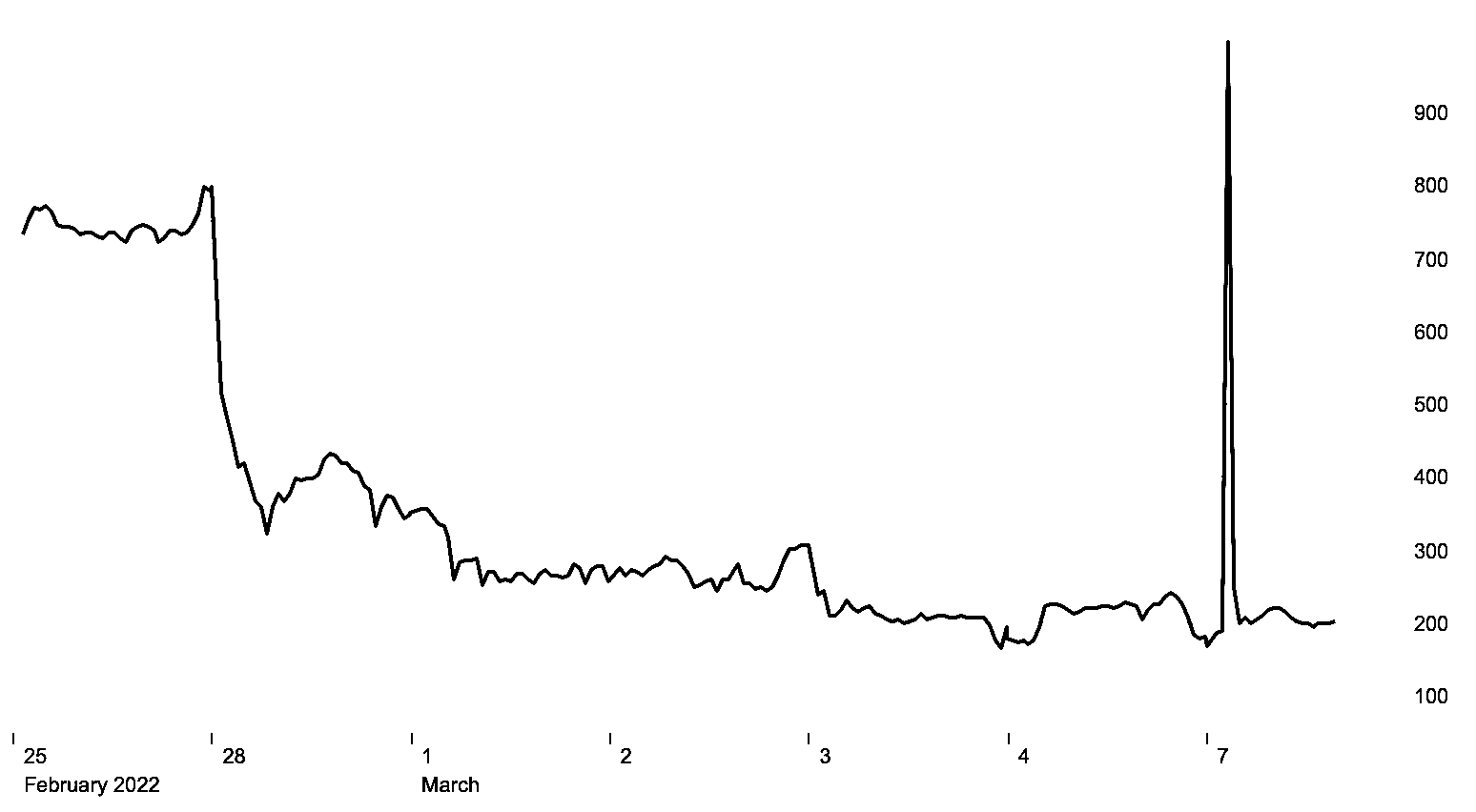

It has been an eventful day for Polymetal (LSE:POLY) and its share price. The Cyprus-based precious metals mining group saw its stock price leap from around 200p to almost 1,400p in early trading on Monday, 7 March 2022. The Polymetal share price had previously slipped from over 1,000p on 23 February 2022 to 170p on 4 March 2022. The price spike might have caused investors in the company — Polymetal has nine gold and silver mines and three in development across Russia and Kazakhstan — to breathe a sigh of relief.

The invasion of Ukraine by Russia and the sanctions placed on the belligerent country explain the drop in the company’s share price. Since the conflict is ongoing, with no concrete signs of resolution, the substantial increase in the Polymetal share price was surprising. It did not last. Almost immediately, stock in Polymetal was trading back around the 200p at which it opened.

Why did the Polymetal share price hit 1,400p?

At around 8:41 AM, multiple orders were placed to trade Polymetal shares on the London Stock Exchange. These orders were at 1,400p per share. Further blocks of orders at 412p, 300p, 250p were received soon after. By 9 AM, the market for Polymetal shares was back around 200p, like the price spike had never happened.

The large Polymetal share price rise early on Monday, 7 March

Source: Financial Times

Early speculation suggested that the 1,400p price was a “fat finger” trade. Someone had made a mistake and entered the wrong price into the market. The follow-up trades at inflated prices could be blamed on algorithms acting on the price momentum. The London Stock Exchange launched an investigation into the aberrant Polymetal trades. It cancelled them just before 11 AM on Monday, 7 March.

It is not unheard of to cancel trades made in error. A notable example was the cancellation of orders in Kraft Foods stock by the NASDAQ in 2012. Kraft’s price spiked by 29% in one minute. The Polymetal share price spike of 700% is more dramatic, but the culprit orders have been closed much in the same way. Indeed, rule numbers 2120 and 3022, which the London Stock Exchanged cited, deal with erroneous trades and enforced cancellations.

Polymetal board changes

At around 10 AM UK time today, Polymetal announced that six board members were stepping down with immediate effect. This move might have been prompted by the trades that were later cancelled as erroneous. But, it is also worth noting that a board member of Evraz, another mining company with Russian focused assets, has also stepped down recently. That would suggest the directors, who are all non-Russian, are leaving in response to pressure from the likes of the Institute of Directors to step down from Russian-owned or Russian-associated companies.

Where does all this leave Polymetal shareholders? Well, the price is back where it was before the “fat finger” trades and well below where it was before the Russian invasion. The price slide has removed Polymetal from the FTSE 100. The company is suffering from repeated distributed denial of service attacks against its website. Sanctions against Russia are hurting Polymetal’s operations and threatening its precious dividend, and might get more onerous. Polymetal has lost six experienced board members, and there is still a threat of the shares being suspended from trading altogether.