When the stock market crashes, it usually drags all stocks with it. All stocks are sensitive to the wider market to some degree. But some stocks are less sensitive than others. The FTSE 100 might fall 5%, but a particular stock might be down only 2%. There is a measure, called beta, that captures the sensitivity of a stock to wider market moves.

What’s the beta of FTSE 100 stocks?

Beta describes how a stock has been observed to react to market moves. A stock with a beta of one behaves in line with the market. Stocks with betas greater than one magnify market moves. For example, if the beta of a stock is 1.5 and the market goes up/down 10%, then the stock is expected to move up/down 15% (10% times 1.5). Stocks with smaller betas tend to under-react to market moves, dropping or rising to a smaller degree than the market. These are the stocks that I want to include in my portfolio if I want to try and protect it somewhat against a market crash.

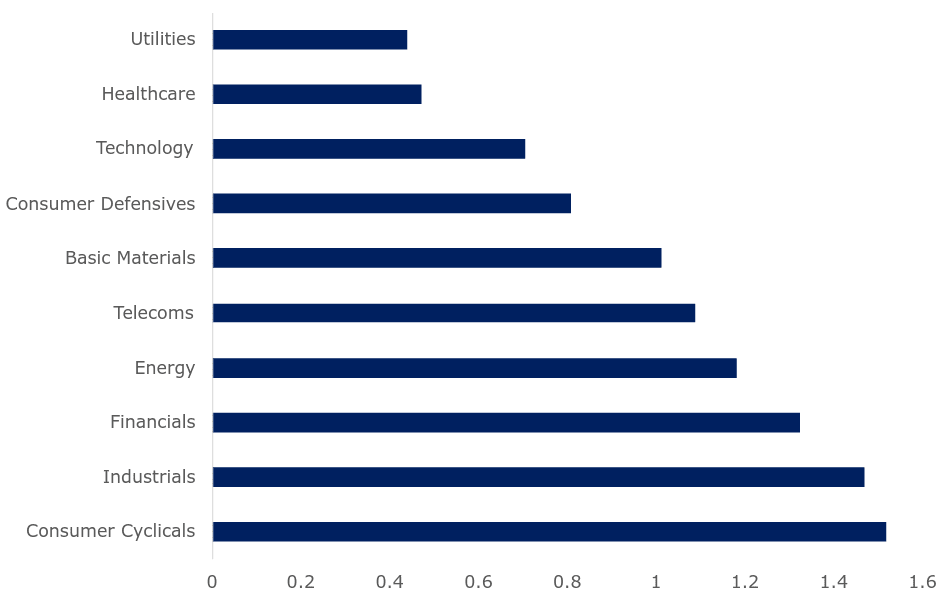

There are about 100 stocks in the FTSE 100. Which ones have betas less than one? Well, rather than sorting a list, I find it more instructive to look at sectors. There are four sectors whose average beta is less than one. The consumer defensive sector average beta is 0.8, technology is 0.7, healthcare comes in at 0.5, and the utilities sector’s average beta is 0.4.

Figure 1. Average beta values for the 10 FTSE 100 sectors

Source: Financial Times and author’s own work

Those results did not surprise me, asides from technology. Healthcare, utilities, and consumer defensives are the types of sectors I would imagine are safer than the others.

Stock market crashes and volatility

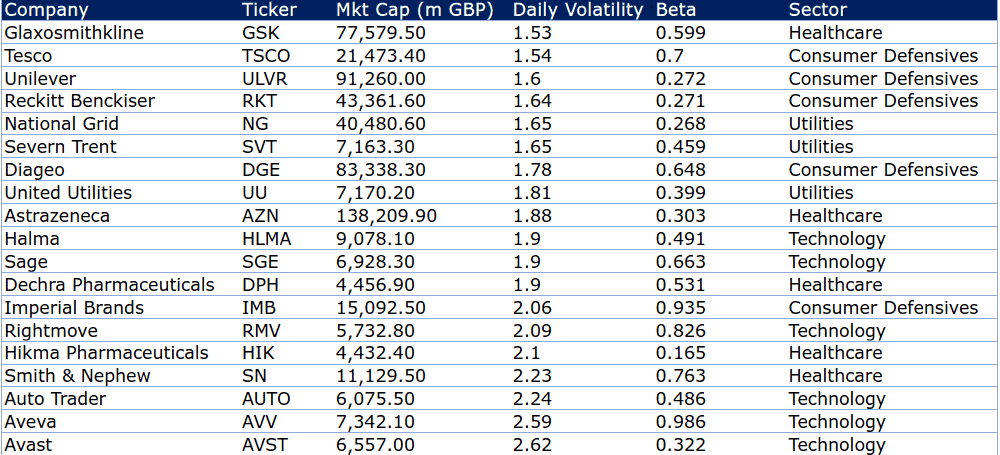

Focusing on four sectors has cut the number of FTSE 100 stocks I have to consider down to 25. This is a more manageable bunch to work with when considering another measure of risk: daily volatility.

Beta gives an idea of the riskiness of stock when considering the broader market. It suggests how a stock moves when events that affect all stocks occur. However, if the stock market is marching higher and a biotech company’s star drug gets withdrawn from the market, its stock price will not go up, no matter what the beta is. Company-specific risk is better measured with the daily volatility of a stock price. So, a table of FTSE 100 stocks from the low beta sectors arranged by their daily volatility seems in order.

Table 1. FTSE 100 stocks from four sectors with low beta and daily volatility

Source: Financial Times

It would be wrong to call any stock ‘safe’. A safe investment has a guaranteed return; stocks do not and are therefore inherently risky. But, some FTSE 100 stocks are safer than others. From the table above it appears that GlaxoSmithKline, Tesco, Unilever, Reckitt, and National Grid offer a combination of both low daily volatility and low beta, at least historically. These are the types of stocks I would want in my Stocks and Shares ISA when the stock market crashes to hopefully protect it, at least to some degree, against a sizeable drawdown. But, as with all things in investing, there are no guarantees.