iShares Global Clean Energy UCITS ETF (LSE: INRG) is very popular right now. On Hargreaves Lansdown, for example, INRG is currently the most owned Exchange Traded Fund (ETF) on the platform. Clearly, UK investors are bullish on the renewable energy theme.

Should I buy for my own investment portfolio? Let’s take a look.

iShares Global Clean Energy UCITS ETF review

Before I take a look at its holdings and performance, it’s worth examining its aim and investment strategy.

Should you invest £1,000 in Card Factory Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Card Factory Plc made the list?

The product’s aim is to generate returns for investors in line with the returns from the S&P Global Clean Energy index. This index is designed to measure the performance of around 100 companies in clean energy-related businesses from both developed and emerging markets. While this index is global in nature, around 40% is allocated to US clean energy stocks.

It’s worth noting that INRG takes a medium-to-long-term view on the clean energy sector.

What renewable energy stocks does INRG hold?

Looking under the bonnet, the iShares Global Clean Energy UCITS ETF contains an interesting list of stocks.

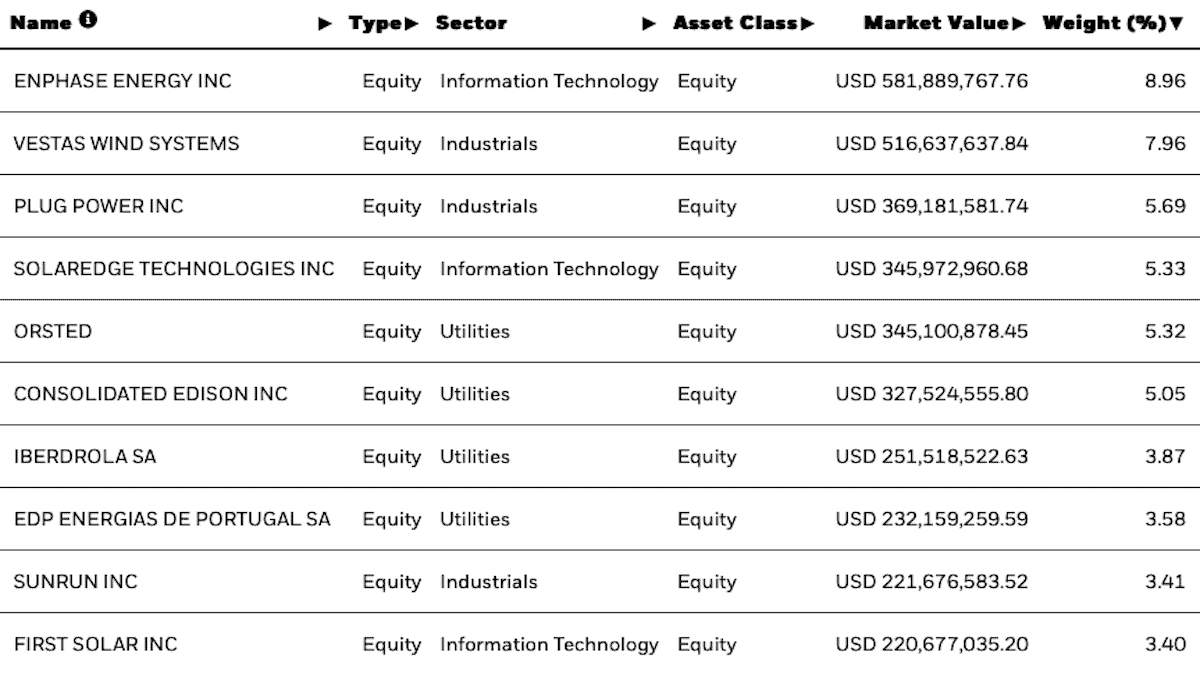

Here’s a look at the top 10 holdings as of 29 October. These made up just over 50% of the portfolio.

There are certainly some good companies in that top 10. Solaredge Technologies, for example, is a stock that stands out to me. Over the last three years, its revenue has grown by an impressive 140%. And it’s profitable too. Last year, it delivered earnings of $140m on revenue of $1.46bn.

At the same time, there are some companies I wouldn’t want to invest in. Plug Power is one. This stock has been targeted by short sellers this year and currently has short interest of around 13%. This suggests many institutions expect the stock to fall.

Overall, I can’t say I’m particularly excited by the top 10 holdings.

Performance

Turning to performance, this has been quite volatile in recent years.

|

This year, the ETF hasn’t performed well. As of 30 September, it was down 22.74% for the year. Considering that global equity markets have generally delivered double-digit returns this year, that’s a poor performance.

However, over the three years to 30 September, the ETF delivered a return of just under 160%. That’s excellent.

Zooming out further, long-term performance hasn’t been so good. Over the 10 years to 30 September, it delivered a return of 186%. That’s below the return of the MSCI World index, which returned 224%. Meanwhile, since its launch in 2007, it has delivered a return of -41%. That’s poor.

Overall, the takeaway here is that performance has been very inconsistent over time. At times, the clean energy sector’s been hot. At other times, it’s been cold as ice.

Should I invest in INRG?

Weighing everything up, I don’t see the iShares Global Clean Energy UCITS ETF as a good fit for my portfolio. I’m not overly bullish on the ETF’s holdings and I’m not that impressed with its long-term performance.

All things considered, I think there are better ways to play the renewable energy theme.