At the moment, I am regularly investing in stocks and shares to build wealth. I hope that one day my portfolio will generate a decent amount of passive income. But what is passive income? And how can I build the value of my portfolio as efficiently as possible?

Passive income

Passive income is money earned in a manner that requires little to no effort. Developing a source of passive income might require hard work, but once established, the income flows without much active participation.

Stocks and shares are potentially fantastic sources of passive income. To generate the money required to invest in a Stocks and Shares ISA will require effort. Not spending money and saving or investing it instead involves discipline.

A portfolio of dividend-paying stocks, held within a Stocks and Shares ISA, could generate tax-free income each year. How much tax-free income depends on the dividend yield of the portfolio and its size. The table below shows the amounts of annual passive income that would be generated by portfolios of different amounts with varying dividend yields.

Table 1. How different portfolio values and dividend yields generate different amounts of passive dividend income

| Portfolio Value | |||||

| Portfolio Dividend Yield | £10,000 | £25,000 | £50,000 | £100,000 | £250,000 |

| 1% | £100 | £350 | £500 | £1,000 | £2,500 |

| 2% | £200 | £500 | £1,000 | £2,000 | £5,000 |

| 3% | £300 | £750 | £1,500 | £3,000 | £7,500 |

| 4% | £400 | £1,000 | £2,000 | £4,000 | £10,000 |

| 5% | £500 | £1,250 | £2,500 | £5,000 | £12,500 |

| 6% | £600 | £1,500 | £3,000 | £6,000 | £15,000 |

Generally, bigger dividend yields and larger portfolios will generate higher amounts of passive income. Alternatively, portions of a stocks and shares portfolio can be sold regularly to generate income.

What are dividends?

When a company makes a profit is has a few options. It can reinvest the profits in the business. It can pay off part or all of its debts. Or it could return the profits to its owners.

There are two ways a company can return cash to its shareholders. One way is to use the money to go into the market and buy back its own shares. The other is to pay a dividend.

A company will typically declare its dividend on a per-share basis when reporting results. For example, National Grid declared a dividend in November 2020 of 32.16p per share. However, the dividend was paid in August 2021 to people who owned shares on 3 June 2021, the ‘ex-dividend date’.

Regular dividends are usually paid annually, semi-annually, or quarterly. There might be occasions when a company pays a special dividend to return cash arising from a special situation, for example, after the sale of part of the business.

What is a dividend yield?

The dividend yield is simply the dividend per share divided by the price per share. Yields are quoted on an annual basis. In National Grid’s case, it paid a final dividend of 32.16p in August 2021 and an interim dividend of 17p per share in January 2021 for a total annual dividend of 49.16p for 2021. National Grid shares are currently trading at 906p. So the dividend yield on National Grid shares is 5.4%, calculated as 46.16/906 x 100.

Dividends typically land in the same brokerage account where shares are registered. Recipients can do what they want with their dividends once they arrive after relevant taxes are paid, which in the case of a Stocks and Shares ISA will be zero. Dividends can be withdrawn and spent as a source of passive income. Or they can be reinvested to potently build wealth.

Compound interest

Albert Einstein is said to have once remarked that compound interest was the most powerful force in the universe. Now, that’s probably an apocryphal tale. Still, if the man that grappled with gravity did think the likes of black holes and supernovas pale in comparison with compound interest, then it’s probably worth investigating.

Here is how compound interest works. I loan someone £1,000 at an annual interest rate of 4% on any outstanding balance. The balance on the loan is £1,040 after a year, assuming no repayments. I am owed the original £1,000 loan plus interest of 4% of £1,000, which is £40. After the second year, again assuming no repayments, the 4% interest payment is calculated on the entire £1,040 balance. I am earning interest on my interest. After two years, I am owed £1,040 plus 2% of £1,040, which is £40.80.

This is the power of compound interest. Every year, the interest payment increases because interest is earned on interest. Add in regular contributions each year, and the effect is more pronounced.

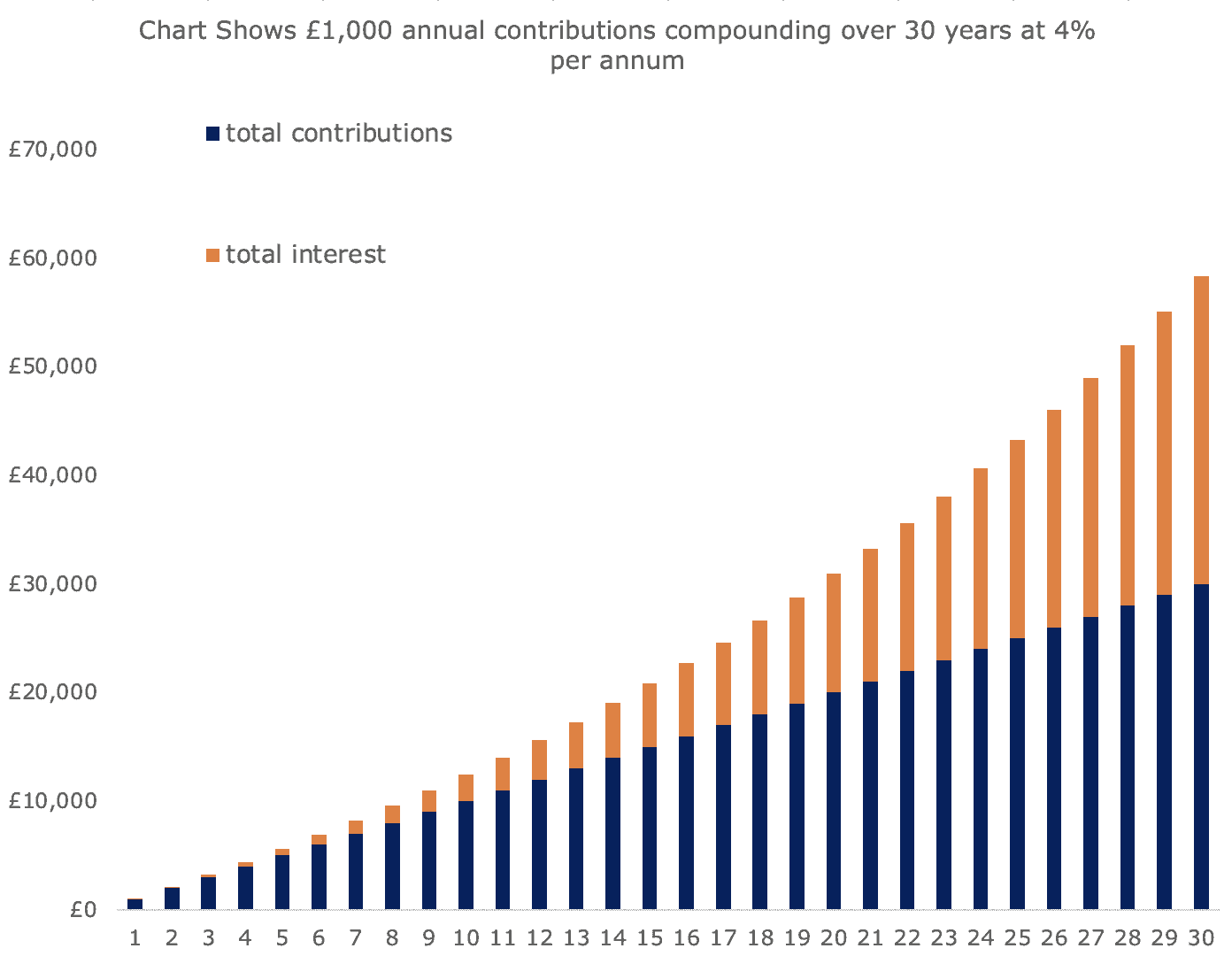

Figure 1. How compounding interest can grow wealth

Regularly investing £1,000 per annum at an interest rate of 4%, compounding annually for 30 years would generate almost £62,000 in wealth: over half of the total wealth is generated from interest payments. The power of regular investing and compound interest is apparent in the chart above. It takes about 11 years to get to £15,000, but only eight to get from £15,000 to £30,000, and then just six to go from £30,000 to £45,000.

Building wealth with dividend reinvestment and capital growth

Banks and building societies are not paying anything close to 4% interest these days. Low-risk government gilts and bonds are similarly low-yielding investments. However, there are plenty of stocks and shares with dividend yields of over 4%. There are also plenty of stocks that have been increasing in price by over 4% for years. Single stock picks can be combined to assemble a portfolio that might be expected to generate an attractive growth rate through a combination of capital gains and dividend payments. Alternatively, funds or index trackers can be bought to get exposure to a broad number of stocks. Of course, dividends have to be reinvested in the portfolio for the compounding effect to take place.

Regarding dividend reinvestment, I prefer to buy the so-called ‘dividend hero’ stocks for my ISA. These are stocks that have not cut their dividend in the last decade. I also look for companies with a track record of earning at least 1.5 times what is paid out in dividends, called dividend coverage. Also, a dividend yield that is not too high (which might suggest a dividend cut is coming) nor too low — somewhere between 2% and 6% — is something I want. Global drinks maker Diageo, consumer goods giant Reckitt Benckiser, and insurer Legal and General meet these criteria.

However, three stocks won’t make a portfolio, so I am always looking for attractive dividend reinvestment and growth opportunities. Combined with regular investing and a long time horizon, I am hoping to build a decent-sized portfolio that will generate a good amount of passive income for me in the future.