On 16 June, furniture and homewares group Made.com (LSE: MADE) listed on the London Stock Exchange via an Initial Public Offering (IPO). Like a few other recent UK IPOs, it wasn’t a huge success. The stock closed down 7% on the first day of trading (although it’s since recovered).

Here, I’m going to look at the investment case for Made.com shares. Should I buy this stock for my portfolio?

Made.com: the business

Made.com retails curated furniture and homewares to customers in the UK, Germany, Switzerland, Austria, France, Belgium, Spain and the Netherlands through a localised e-commerce platform.

Since its launch in 2010, Made.com has grown significantly and along the way has developed a large, active and loyal customer base. Last year, it had around 1.1 million ‘active’ customers (unique customers who shopped at least once during the year). The brand is particularly popular with Millennials.

Made.com operates a vertically-integrated business model that covers the entire product lifecycle from product development and sourcing through to global shipping, warehousing, and home delivery. To create its product range, it partners with over 150 established and up-and-coming designers, artists, and collaborators.

The IPO price was 200p per share, valuing the company at around £1.2bn.

Made.com shares: the bull case

From an investment point of view, there are a number of things I like about Made.com. Firstly, I think the company has a great offer. In the last few years, I’ve purchased a number of its products, including a leather sofa, an armchair, and a sideboard and, overall, I’ve been very happy with the products. Made.com seems to offer high-quality products at good price points.

It’s worth noting that Made.com has over 11,000 reviews on Trustpilot and overall has a ‘great’ rating with a score of 4.2 out of five. By contrast, IKEA has a score of 1.5. So, clearly, Made.com is doing something right. It also has more than 3m followers across its social media accounts.

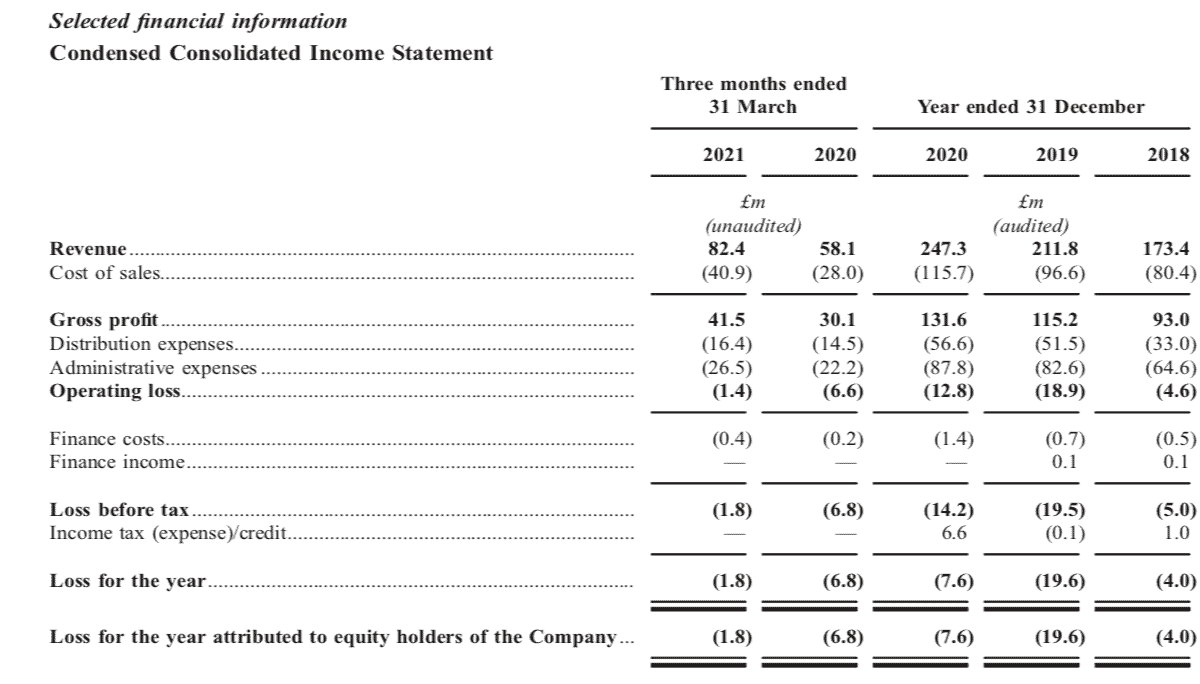

Secondly, the company’s growth in recent years has been impressive. Made’s IPO prospectus reveals that last year it generated revenue of £247.3m, up from £211.8m in 2019 and £173.4m in 2018. So annualised growth over this period was 19.4%. That’s pretty good, given UK economic conditions last year.

Source: Made.com

Risks

However, I do have some concerns about Made.com shares. One is that the company still isn’t profitable. Last year, its net loss was £7.6m. This adds risk to the investment case. We’ve seen recently that the share prices of companies with no profits can fall sharply in a market sell-off.

Another issue is the competition the company faces. Not only does it face competition from established rivals such as Ikea, DFS, and John Lewis, but it also faces competition from newer companies such as Loaf. In this industry, barriers to entry are minimal.

Finally, there’s the valuation. At Made.com’s current valuation, it has a trailing price-to-sales (P/S) ratio of about 4.85. I see that as quite high. By contrast, online retailer ASOS has a P/S ratio of 1.5.

Made.com shares: my move

Looking at the risks to the investment case, I’m going to keep Made.com shares on my watchlist for now. All things considered, I think there are better stocks I could buy at present.