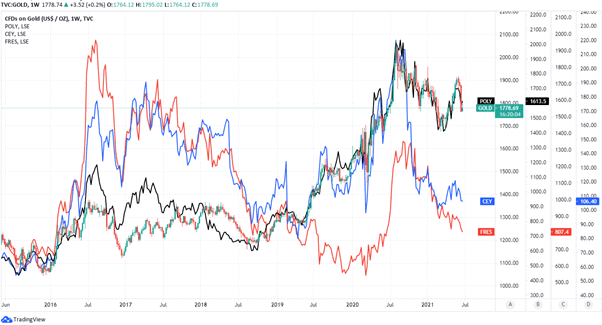

Gold mining stocks Polymetal (LSE: POLY), Fresnillo (LSE: FRES) and Centamin (LSE: CEY) are among the worst performers on the London market in 2021 but I’m anticipating a comeback over the next year or so.

Miners are as varied in performance this year as are the kinds of minerals they extract from the earth, and while I think the mismatch results from differing commodity price changes and company performances, gold mining stocks are by the far the laggards.

Fresnillo was bottom of the FTSE 100 this week after falling 27% in the almost-six months to late June while Pretty Poly(metal) was eighth from bottom of the same benchmark despite falling only around 4.4%. Meanwhile, a 12.1% fall has left Centamin tenth from bottom of the FTSE 250.

All of this follows a period in which gold itself has fallen 6.37% to $1,778 per ounce and so, with the exception of Polymetal, these performances seem like an overreaction to a gold price that could soon bounce back in the direction of record highs seen above $2,000 in July 2020.

Most compelling among reasons for a gold price recovery, I find, is central bank demand and what it potentially says about the expected direction of an often-negatively correlated U.S. Dollar. However, a seemingly downbeat outlook for the latter is also a reason on its own.

Many central banks have grown reserve assets of late, and may have somewhat similar views on big questions like the Dollar and by implication, gold, though not all publish data as detailed as the Reserve Bank of Australia (RBA). The RBA grew FX reserves and total reserves by nearly 15% in March, with growth in those categories slowing markedly thereafter, while gold holdings have since increased at double-digit percentages, despite falling prices.

Nothing can be said for certain but this might reflect the expectation of rising gold prices from which I think Fresnillo and Centamin would benefit more than Polymetal, given the latter is less volatile than others.

Russia’s Polymetal is better at mimicking gold prices, which are less volatile than many shares, potentially making it a lower-risk sector exposure, while Fresnillo is a ‘high cost producer’ and the lowest margin company in the sector whose shares tend to overreact more to movements in gold.

This makes it higher risk, but also potentially a higher reward: the shares have underperformed sector peers when falling more than 40% from above £13:00 last July, a period in which gold itself has fallen by only around 15%, but did also respond more strongly when prices were rallying last year.

Fresnillo far outpaced gold and its peers in 2020, but I won’t be writing off Centamin as a dark horse contender for outperformance in any gold price recovery, given the debt-free company’s shares have been held back this year by one of many occasional production stoppages at its flagship mine.

Centamin also still has scope to offer a best-in-class 6% dividend yield – better explained here by G A Chester – along with magnified exposure to any gold price recovery, although it goes almost without saying that each of these shares could perform badly if gold prices fall further.