I own stock in National Grid (LSE: NG) for its dividend. The National Grid share price is important to me, but mainly as an input to calculating the dividend yield. At the moment, the company is going through a transition. The question I need to answer when deciding to buy, hold, or sell National grid stock in my Stocks and Shares ISA is if the dividend is safe or not.

Electrifying

National Grid has been reducing its exposure to gas since 2016 and pivoting towards electricity. That seems like a strategically sound move. In the UK, electricity demand is expected to double or even treble by 2050 if net-zero emissions targets are met.

The recently announced planned purchase of Western Power Distribution (WPD) for £14.2bn is another step away from gas. National Grid is selling its Rhode Island, US, gas and electricity business to the same American firm it is buying WPD from for $5.2bn.

Should you invest £1,000 in National Grid right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if National Grid made the list?

Buying WPD would move National Grid into local electricity distribution in the UK. The company currently owns high voltage national transmission networks (think pylons) that move electricity across the country. If shareholders approve the WPD deal, National Grid would end up with 70% of its assets in electricity transmission. Later this year, a majority stake in National Grid Gas is planned to go under the hammer. That would see National Grid completely leave the UK gas market.

Company management expects the entire WPD transaction to boost earnings from year one. In the long term, the shift to electricity is expected by both management and analysts to boost earnings. Higher earnings can support higher dividends.

National Grid dividend

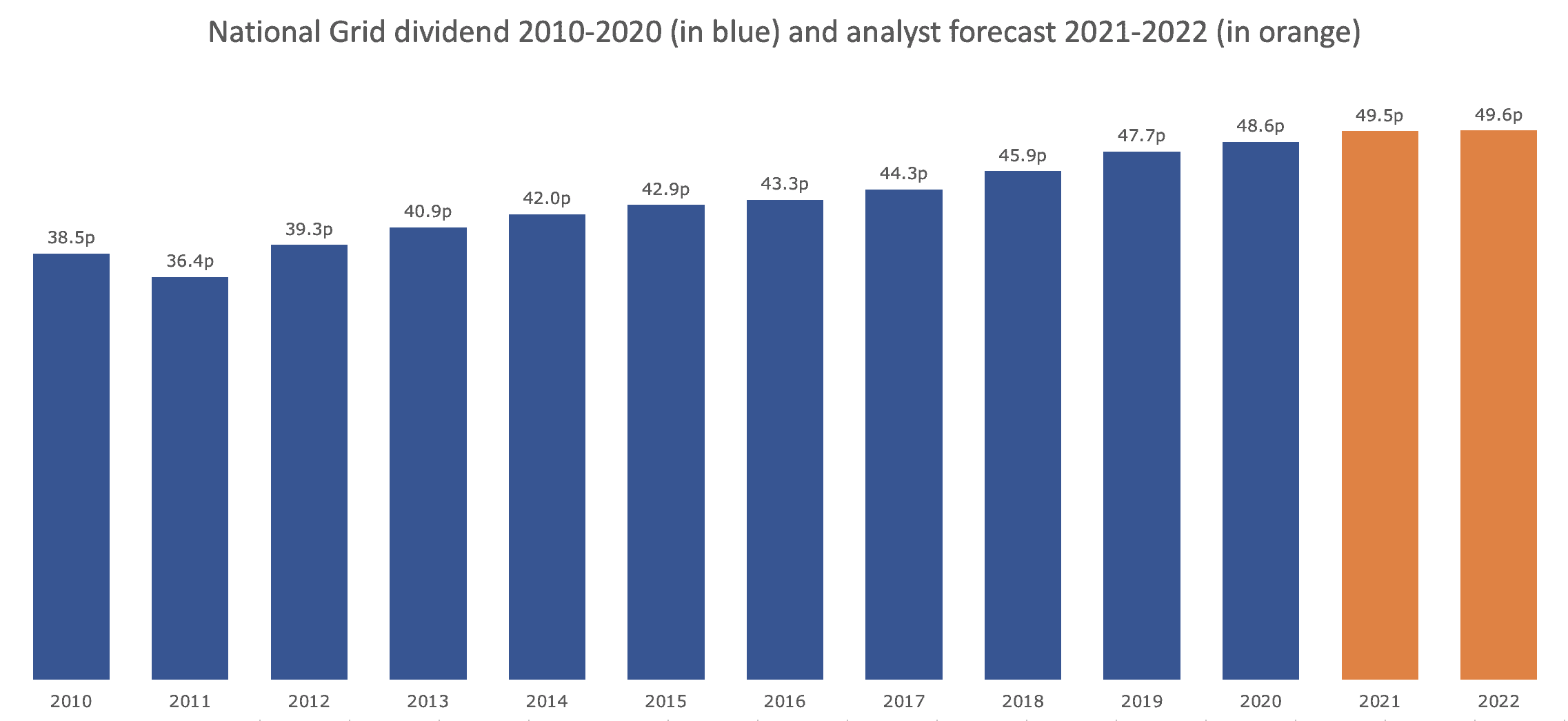

There is no doubt that National Grid shares have been solid dividend payers. After a dip from 38.5p to 36.4p per share from 2010 to 2011, National Grid shareholders like me have seen their dividends increase every year. There was even a special dividend of 84p in 2017. The latest dividend, for 2020, was 48.6p. The trailing dividend yield on National Grid shares is a solid 5.5%, on a current share price of around 890p.

Source: Company accounts and Koyfin

The analyst consensus for dividends to rise to 49.5p and 49.6p for 2021 and 2022, respectively. Perhaps I am pessimistic, but I am not so confident.

I will hold my National Grid shares

National Grid might be forced to forfeit its role in managing the supply and distribution of electricity. According to analysts at Barclays, this is a small business, and National Grid might be due around £300m in compensation. An appeal against an Ofgem decision to reduce allowed returns on equity to 4%, down from 7%-8% from April 2021 onwards for national electricity network operators, is in process. Ofgem is also proposing cutting annual rates of return from 7% to 4.4% for local network operators for five years from 2023; a final ruling is due in December 2022.

These appealed and planned cuts are significant. They are potentially damaging for dividends for a company that is already paying out around 70% of regulated earnings (as cash and scrip dividends). The WPD deal is also pricy, with National Grid paying 26 times net profit, and shareholders still need to approve it. A potentially positive long-term outlook with significant short-term risks makes me think that holding onto my National Grid shares is the right move for now.