One stock that’s been getting plenty of attention this week is Coupang Inc (NYSE: CPNG). It listed on the New York Stock Exchange via an Initial Public Offering (IPO) yesterday. Demand for its shares was high – the stock finished up 40% on its first day of trading.

Is this a growth stock I should consider for my own portfolio? Let’s take a look at the investment case.

Coupang: business description

Coupang is a South Korean e-commerce company founded in 2010 by Korean-American billionaire Bom Suk. Nicknamed the ‘Amazon of South Korea,’ it has a large market share within the South Korean online shopping industry. Across the country, it has more than 100 fulfilment and logistics centers in over 30 cities. These allow the company to provide next-day delivery for orders placed before midnight.

Coupang’s IPO price was set at $35. However, on the first day of trading, the stock closed at $49.25. At that share price, the company’s market capitalisation is around $84bn.

The company has some notable backers, including Japanese investment giant SoftBank, US wealth management powerhouse BlackRock, and US venture capital firm Sequoia Capital.

Can Coupang stock keep rising?

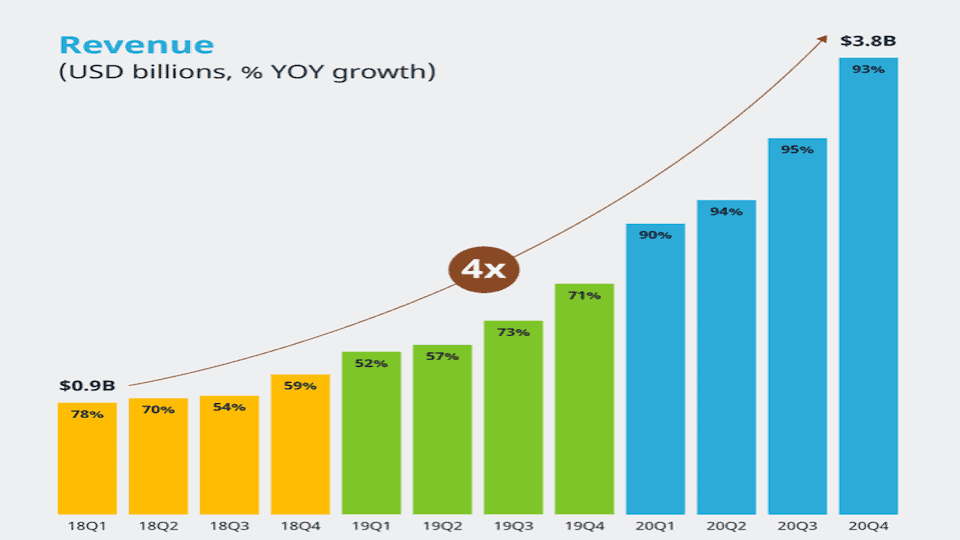

Coupang’s recent growth has been impressive. For the year ended 31 December 2020, the company generated net revenue of about $12bn, up 91% year-on-year. This compares to growth of 55%, 69%, and 44% in 2019, 2018, and 2017 respectively. During 2020, it increased its market share significantly, from around 18% to just under 25%.

It’s worth noting that South Korea’s e-commerce market, as a whole, is growing rapidly. According to Coupang, total e-commerce spend is expected to hit $206bn by 2024, up from $128bn in 2019. That represents annualised growth of about 10%. This market growth should provide tailwinds for the company going forward.

Risks

While this all sounds promising, I do have some concerns about Coupang stock. One is that the company is still unprofitable. Last year, the company lost about $475m. The year before, it lost about $700m. The company says it’s not certain whether or when it will achieve or maintain profitability. This adds risk to the investment case. That said, Amazon was unprofitable for years.

Secondly, the company does have quite a bit of competition. Rivals include eBay-owned Gmarket, Naver Shopping, and WeMakePrice. Coupang says it faces “intense” competition and could lose market share if it doesn’t innovate.

Third, the company has recently faced some criticism over working conditions for its employees. Labour groups in the country recently reported that a Coupang delivery driver in his 40s had died from overwork. This is an issue to keep an eye on.

Finally, there’s the valuation. This looks quite high, in my view. Let’s say Coupang generates revenue growth of 65% this year (that’s my own estimate – I’ve used the average of the last four years’ growth to get to that figure). That equates to sales of about $20bn this year. That means the stock’s forward-looking price-to-sales ratio is about 4.2.

By contrast, Amazon trades on a forward-looking price-to-sales of ratio of 3.3. Amazon isn’t growing as quickly as Coupang. But it is profitable and also has its high-growth cloud business.

Coupang stock: my view

Weighing everything up, I’m going to keep Coupang on my watchlist for now. The company certainly looks interesting. However, at present, I think there are other stocks that are a better fit for my portfolio.