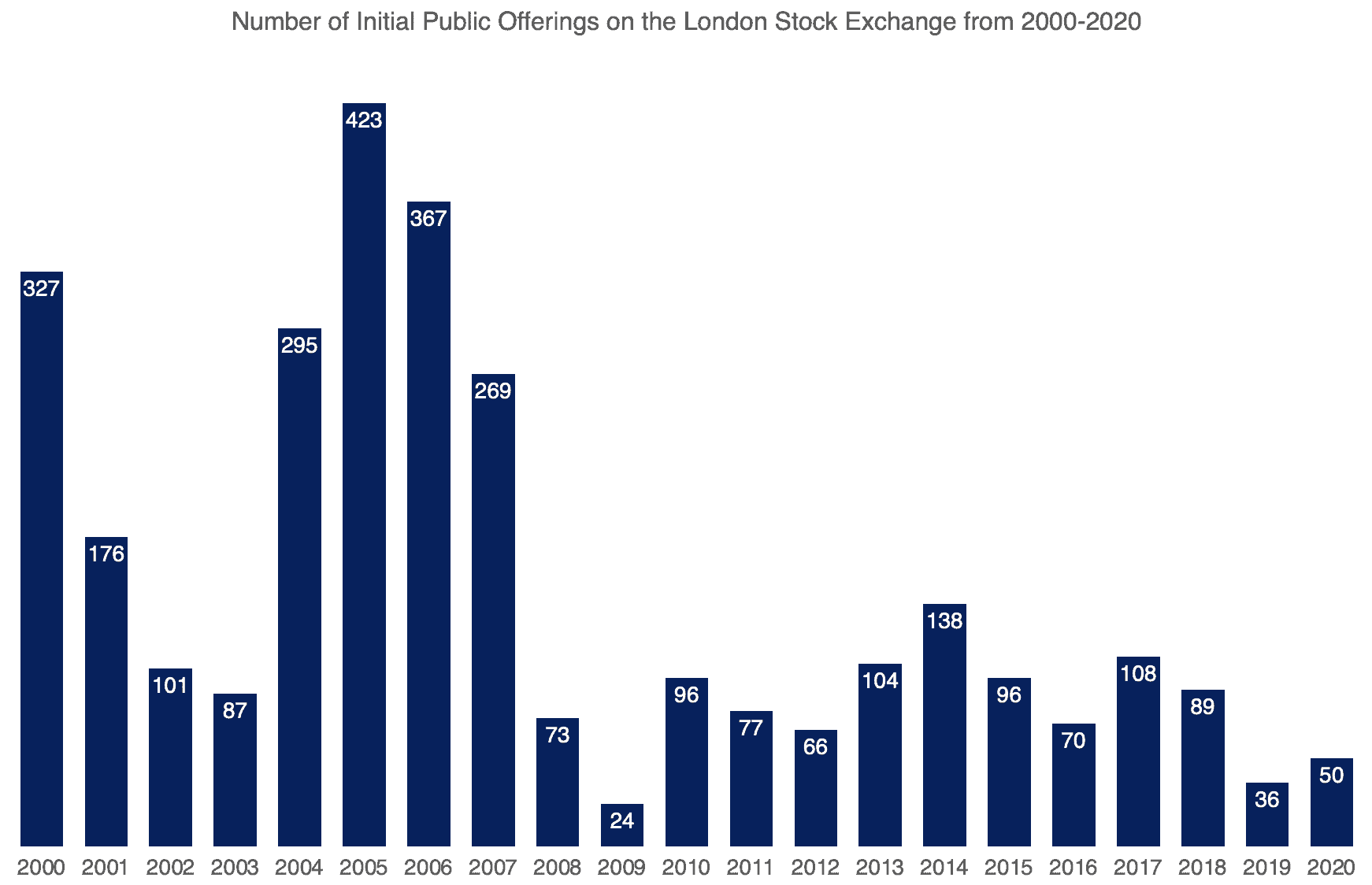

I have read that the coronavirus pandemic weighed heavily on the number of initial public offerings (IPOs) hitting the London Stock Exchange (LSE) in 2020. However, after taking a look at the data myself, I can see 50 IPOs in 2020 compared to 36 in 2019 (the lowest figure since 2009).

Source: London Stock Exchange new issues and IPOs data

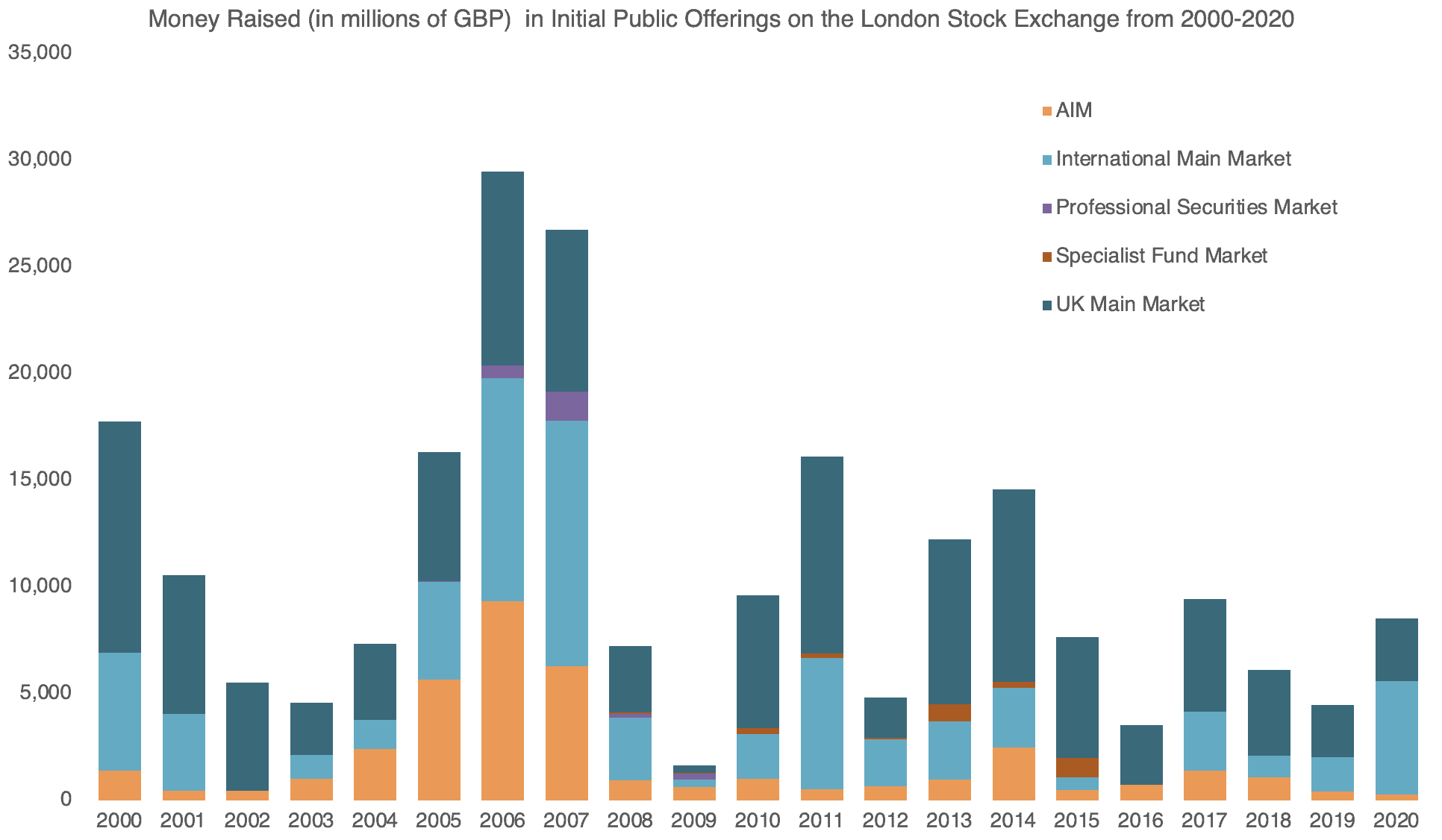

Through the London markets, companies conducting their IPOs raised £8.5bn in new capital in 2020. That is almost double the £4.4bn raised in 2019. The Hut Group, which describes itself as a digital-first consumer brands business, went public at 500p per share in September 2020. It alone raised £920m in new capital through the IPO, or around 11% of the 2020 total.

Source: London Stock Exchange new issues and IPOs data

The Hut Group’s share price has since risen to 717p, taking its market cap from £4.5bn to £7.14bn. Investors at the IPO price got a 43% return in just five months. But not all IPOs glitter like gold. Guild Esports, which owns and develops esports teams, had an IPO share price of 8.5p when it hit the markets in October 2020. Shares traded as high as 10p in October of last year but have since slumped, and now sit around 5.95 pence.

London IPO market revving up in 2021

Moonpig, an online greeting card company, went public last week with an IPO share price of 350p. Conditional dealing — which takes place before the shares are actually admitted to the market — took the market price of Moonpig shares to 450p. An investor in Moonpig might be happy if they snapped up shares at the IPO price. If they had a Stock and Shares ISA, they might have received an invitation to apply. Investors who bought after the shares hit the market would be nursing a 25p per share loss as the Moonpig share price has fallen back to 425p.

Dr Martens went public on 3 February 2021. Shares in the iconic British footwear brand hit the markets at around 450p — well over the oversubscribed issue price of 370p — and are now worth around 510p. And there are plenty of other companies rumoured to be going public through the LSE in 2021. Deliveroo’s founder and chief executive confirmed in late January 2021 that the company was working on plans for an IPO. There has been a lot of speculation Deliveroo could go public in the first quarter of 2021. That seems a stretch right now, but I would not rule out a floatation sometime this year.

IPOs to watch out for in 2021

According to Bloomberg, the LSE is pushing for the UK government to shorten the process for taking companies public. This would bring practices in the London market more in line with the US and continental Europe. The LSE is also said to support relaxing the 25% minimum free float requirement and allowing dual-class structures for premium market listings. This would certainly make fast-growing tech companies, like Deliveroo, look more favourably on a London listing.

Indeed, multiple tech companies are rumoured to be planning an IPO on the LSE this year. Darktrace, which offers an artificial intelligence-driven cybersecurity platform, is one of them. Transferwise, an online money transfer service specialising in cross-border transactions and foreign exchange, is another. The London IPO market does appear to be hotting up in 2021.