‘Tis the season of goodwill. But, does the magic of the Christmas season extend all the way to the FTSE 100? The UK’s main stock market index is up 4.2% already, and we are not even halfway through December. That might cause investors to believe that the so-called Santa Claus Rally is more fact than fiction. However, the general cheer about coronavirus vaccines being rolled out in the UK and the pandemic looking to be coming to an end is probably a better explanation of why the FTSE 100 is performing strongly.

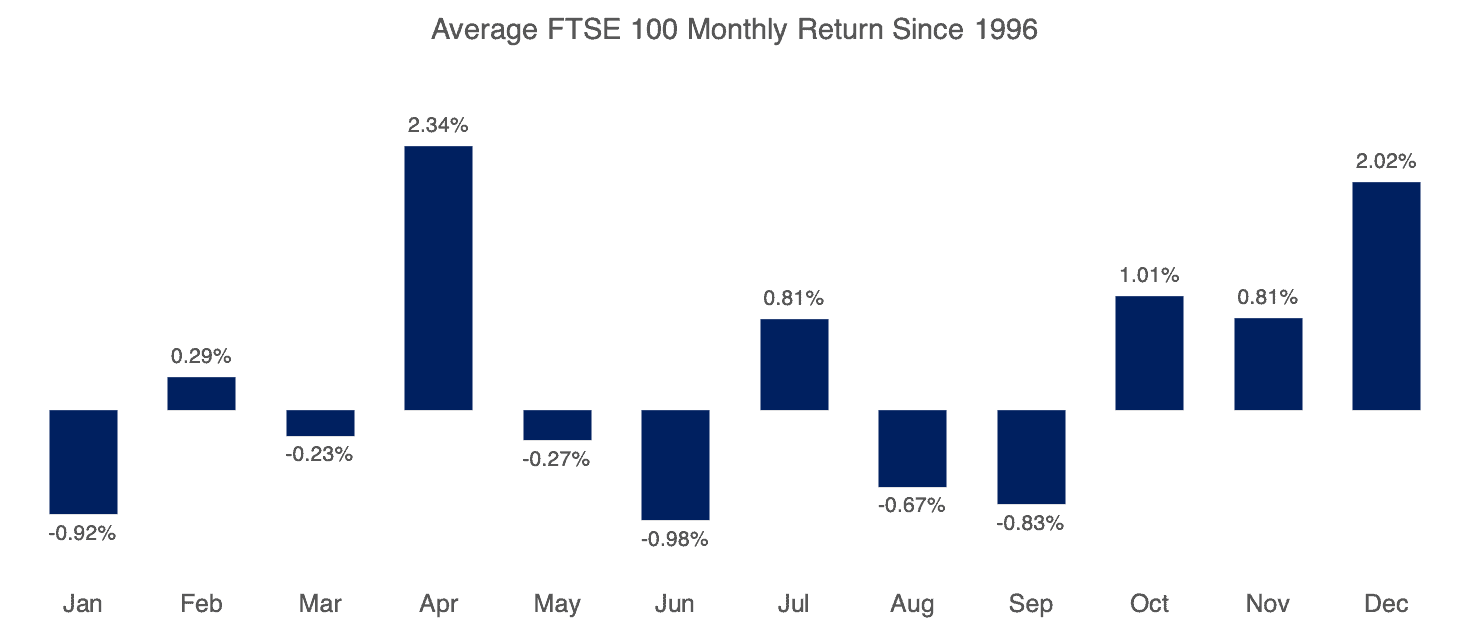

Looking at the average monthly returns for the FTSE 100 in December, and the other 11 months, going all the way back to 1996 should provide a clearer picture. After looking at the data, there might be some truth around the idea of a Santa Rally lifting the FTSE 100 in December.

Has the FTSE 100 been naughty or nice?

The Santa Claus Rally was identified in 1972, by a stock market analyst and author called Yale Hirsch. Specifically, it refers to a tendency of stock markets to rise in the last week or so in December. Market commentators have, however, extended the original observation to December as a whole. So, how does the FTSE 100 tend to perform in December?

Should you invest £1,000 in NatWest Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if NatWest Group made the list?

Well, the average monthly return on the FTSE 100 index in December is 2.02%. That is higher than any other month’s average return, save one, going all the way back to 1996. The average return in April was, in fact, the highest at 2.34%. However, my efforts to get the Easter Bunny Hop recognised have failed. That’s probably because Easter sometimes falls in March.

Source: Yahoo Finance and author’s own calculations

So let’s get back to the FTSE 100 and December. On average the market rises more in December than any month other than April. December also has the lowest standard deviation of returns at 2.98%, meaning they are less spread around the average compared to other months.

That does not mean that losses do not occur in December. The worst December performance for the FTSE 100 was -5.49%. In comparison, the worst returns in April and November were -3.25% and -4.6% respectively.

What does this mean for investors?

It’s an interesting observation that the FTSE 100 does tend to perform better in December compared to other months, except for April. The Santa Rally might indeed be real rather than fiction. Will this change how I invest? No, it won’t.

Although there are numerous theories around why markets tend to do better in December, none of them has proved conclusive. Returns are not always positive in December, and there is no reliable way to predict if a Santa Rally will occur. I can’t tell which years will see the Easter Bunny Hop either, unfortunately.

In an earlier article, I demonstrated that time in the market beats trying to time the market over the long-term. Trying to catch a Santa Rally or even an Easter Bunny Hop, is trying to time the market. Over 25 years or so I might get that average 2.02% or even 2.34% return. However, The FTSE 100 has returned 8.33% per year on average over the last 25 years, including dividend reinvestment. I would rather be in the market for the long term, rather than trying to time it.