Omega Diagnostics Group (LSE:ODX) shares have had a wonderful time this year. They have rallied hefty 800% since the start of the pandemic! But how much further can the micro-cap rise from here?

ODX shares and their wild rally

As its name suggests, Omega Diagnostics Group specialises in providing medical testing equipment. As of writing, its market capitalisation is £104m. Although the ODX share price has recently gained a lot, it is still a micro-cap stock. Generally speaking, micro-caps are considered to be speculative investments. But let us look at the reasons for such a wild rally.

ODX has three operating segments. The first one specialises in allergies or food intolerances. The second department provides HIV testing equipment. The third one manufactures Covid-19 rapid tests.

Should you invest £1,000 in Capita Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Capita Plc made the list?

I am sure that the stock has rallied because of the rising demand for these tests. Earlier I wrote about Novacyt, a small biotechnology company, that also sells coronavirus tests. The stock market reacted in a very similar manner to its company rising sales. Novacyt’s other stock fundamentals, however, were quite pathetic.

As I’ve said, micro-caps tend to be risky. At the same time, if you buy a micro-cap with sound fundamentals and a good future, you might end up getting a fortune from a small investment. So, let’s examine ODX shares in a bit more detail.

ODX fundamentals

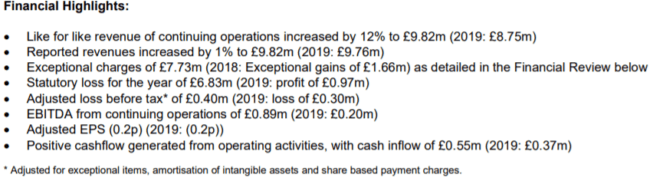

The results for the year ended 31 March 2020, published on 14 July 2020, weren’t very impressive.

Source: Omega Diagnostics Group

Overall, in spite of the modest 12% sales rise, the loss for the year increased. Logically, the net cash flow declined too. As can be seen from the numbers above, the company is extremely small.

But the most recent news is really encouraging. ODX plans to sell 200,000 new coronavirus tests every week starting in October due to soaring demand. Given the company’s scale and size, it looks like a great revenue boost.

Here’s what I’d do

Although the performance improvement seems impressive, I wonder how sustainable the ODX shareholders’ party will be. There is still plenty of uncertainty regarding the pandemic. My own stance is rather cautiously pessimistic. True, I read a lot of positive news about the development of a Covid-19 vaccine. But it still looks like it will take a long while for a vaccine to be widely available. And even if that happens, it means the demand for Omega’s tests will fall.

On the positive side, ODX is well diversified. As I’ve mentioned, the company also specialises in HIV and food intolerance testing equipment. What’s more, it doesn’t focus on one country or one market. When demand for Covid-19 tests does fall, ODX can devote more resources to its other two departments. The good thing is that the Covid-19 tests will provide the company with a great deal more cash than it used to have. So, it will be in a better financial shape to operate after the end of the pandemic.

Still, if the demand for coronavirus tests plunges soon, many shareholders will get rid of their ODX shares. It will obviously lead to a sharp fall in the stock price. I’d personally avoid the stock and look for some other small-cap shares instead.