It’s really hard to find an excellent growth stock to buy now. That’s because most of them are really expensive. Many smaller and cheaper companies, meanwhile, haven’t been operating for a long time. So, it’s a risk to buy them. But I think Nokia (NYSE:NOK) stock is undervalued and great for UK investors to buy. It’s a large company with a long history and a bright future.

5G war

The UK’s government supported the US in the trade war with China. So, the UK’s mobile providers are being banned from buying 5G equipment from Huawei from the beginning of 2021. This seems to be a worrying sign for companies like BT. But why don’t we think of this as a great investment opportunity? There are two companies to benefit directly from the current situation. In other words, the UK will switch to other 5G equipment producers. The largest of Huawei’s competitors are Nokia and Ericsson. In this article I’ll focus on Nokia stock and its relevance for UK investors.

Nokia stock fundametals

To start with, the UK isn’t the first country to ban Huawei’s production. This campaign against the company started long before the British government’s announcement. So, Nokia could be an attractive alternative to the Chinese giant in many countries.

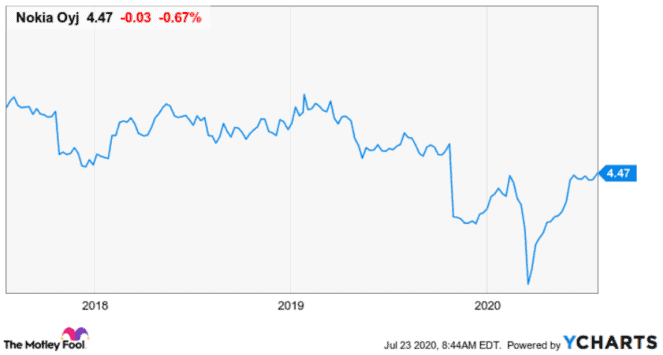

Although Nokia stock rallied in the last few months, the company’s shares had a tough time in the last several years.

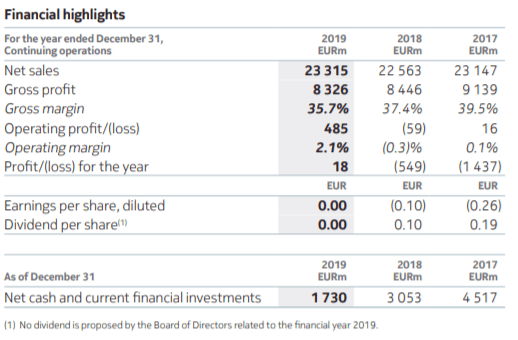

That’s because the company’s financial performance was quite pathetic. In fact, in the last couple of years Nokia’s business was loss-making.

Source: Nokia

As we all know, long ago Nokia was famous as a great mobile phone producer. But it failed to start producing smartphones in time. In 2014 it even had to sell its mobile phone business to Microsoft. But Nokia changed its profile some time ago. Most of its sales are now due to mobile networks. 5G is definitely part of this. In fact, it’s the management’s priority to switch from 4G to 5G technologies.

You could see from the table above that the company’s losses started decreasing. In 2019 Nokia even managed to break even. This was due to the company’s cost-cutting initiatives. And many analysts think that the company will become profitable this year and even start paying dividends next year.

I don’t like judging companies by their future performance. In order to invest, I’d rather have a really profitable company with high and stable dividends. But I see some opportunities here. Nokia stock is still trading at pretty low prices. Most of the company’s revenues come from Western countries, which are quite likely to ban Huawei’s 5G technologies and switch to companies like Nokia. What’s more, Nokia’s market share, excluding China, is 27%. That’s a lot. But this competitive position comes at a costs. Nokia’s net cash declined significantly. Last year Moody’s even downgraded the company’s credit rating to Ba2. That’s quite a low credit rating.

This is how I’d invest to get rich

I consider myself to be a value investor. But growth shares offer many opportunities to get rich too. Although Nokia stock isn’t a perfect buy for a risk-averse investor, I think it still offers an attractive opportunity.