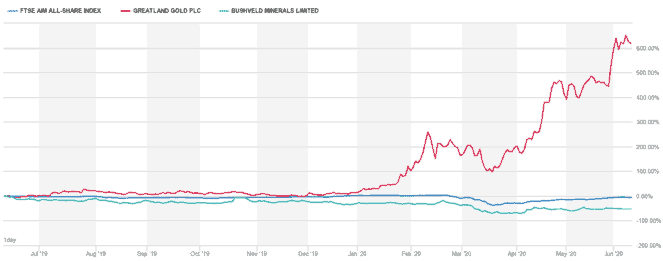

The share prices of Greatland Gold (LSE: GGP) and Bushveld Minerals (LSE: BMN) are rallying. Despite the coronavirus-induced stock price plunge in March, shares in Greatland are up 630% from a year ago. Although Bushveld’s market value is still only half its June 2019 price, its shares have climbed 44% over the last three months.

Greatland Gold’s blazing trailing 12-month performance leaves the FTSE AIM in its wake (click chart to enlarge):

Bushveld Minerals trails the index in this regard. However, excluding its 2018–19 outlier year, the vanadium miner is trading at prices it’s not seen since 2012.

Every investor wants to buy stocks that perform above the average over time. Indeed, growth stocks such as these miners could be one way to do exactly that.

But, can these two mining stocks be expected to maintain this performance in the future?

Greatland Gold

One person who believes in Greatland Gold’s prospects is its CEO, Gervaise Heddle. Back in March, Heddle bought enough shares in the gold miner to bring his ownership stake to 1.5%.

Some investors believe that putting all your eggs in one basket is a good way to make a fortune. Judging by the optimal timing of his share purchase, this could be true for Heddle, who has intimate knowledge of Greatland’s business.

Not having that intimate knowledge, I’d personally be more hesitant to make a bulk purchase in Greatland, especially after the recent share price hike. Currently trading at around 12.5p, Greatland Gold has no price to earnings (P/E) ratio. This is because it hasn’t reported any previous earnings or any profits with which to calculate a ratio. The current share price is based purely on future optimism.

However, the future could be gold. Greatland’s Havieron gold-copper discovery in Western Australia looks promising. And on Monday, the firm announced a series of agreements, which are now in place, relating to the exploration of the region with partner organisations. These will help with obtaining a mining lease to enable Greatland to begin mining operations. But it will still be a while before the firm begins revenue generation from any gold found.

Bushveld Minerals

Bushveld Minerals is another stock where the majority broker consensus is to buy. The firm produces Nitrovan vanadium, an additive for high-strength, low-alloy steel that can lower steel production costs.

The Bushveld share price is currently reflective of the trade-off between low vanadium prices and good business management. The former reduced revenue while the latter produced the lower overheads that compensated for that drop.

Although the effects of the Covid-19 pandemic are concerning for the firm, its Vametco mine’s first-quarter vanadium production rose despite the lockdown. Indeed, many analysts are expecting an increase in production for 2020.

As for Bushveld’s future, the recent three-year wage agreement with Vametco’s workers gives stability. Moreover, the firm hopes that the recent addition of the Vanchem plant will turn Bushveld Minerals into one of the most significant low-cost, and most vertically integrated, miners.

I’m not convinced a portfolio of growth stocks will yield a better return than a more balanced one. It also comes with greater risk, as does gold mining. Greatland Gold’s current price is too speculative for me as its future is too uncertain. But, I am tempted by Bushveld as a speculative purchase in an otherwise balanced portfolio.

Credit: London Stock Exchange

Credit: London Stock Exchange