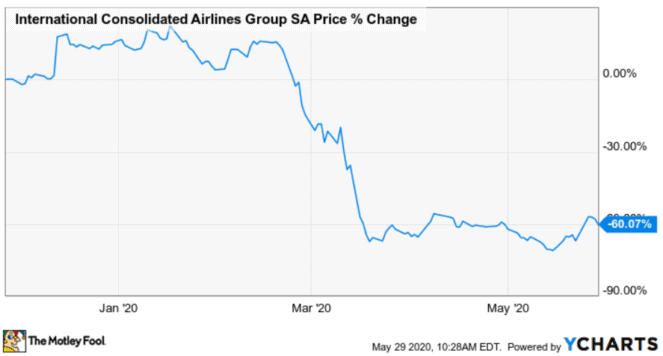

The International Consolidated Airlines (LSE:IAG) share price has fallen by 60%. This has been largely due to the coronavirus pandemic. Is it now a bargain or a value trap?

Stock price and financials

As can be seen from the graph, IAG’s shares have plunged by 60% from their February highs. We all know that it has been due to the coronavirus pandemic and lockdown, which has led to a record fall in the number of flights. However, let us look at the company’s financial figures.

| Year | 2019 | 2018 | 2017 | 2016 |

| Revenue (€m) | 25,506 | 24,258 | 22,972 | 22,567 |

| EPS (€c) | 116.8 | 117.7 | 102.2 | 90.2 |

| Dividend (€c) | 60.11 | 23.49 | 20.25 | 17.96 |

| Net Debt (€m) | 7,571 | 6,430 | 655 | 2,087 |

Source: IAG

As can be seen from the table above, the company’s revenue kept increasing between 2017 and 2019. The earnings per share (EPS) were quite stable as well. In 2019, IAG’s shareholders even received a special dividend, and dividends were well covered by earnings. In spite of the company’s profitability, its debt load increased. IAG’s net debt (total liabilities – cash) rose dramatically between 2017 and 2019.

The stock is trading at record low levels now. But the share price reflects the airline’s current state of affairs. According to the company’s report for the three months to 31 March, sales revenue plunged by 13.4% compared to the same period in 2019. Even though the pandemic didn’t have that much time to affect the operations of the airline, the IAG ended the first quarter of 2020 with a loss of €1.68bn as opposed to a profit of €70m for the same period a year ago.

However, the worst is yet to come since the company reduced its passenger capacity by 94%. It means that demand for flights would probably fall by this amount.

Finally, although the current dividend yield of more than 5% looks attractive, it is not sustainable. So, overall, it is obvious that the airline is struggling.

IAG’s future

That’s why the company’s credit rating was downgraded by Moody’s. Instead of Baa3, it is now Ba1 – a junk credit rating. At short, Moody’s doesn’t believe in the industry’s near-term future. The reason being, the agency expects the airline industry to only recover 2019 passenger volumes in 2023 at the earliest.

According to Moody’s, IAG’s liquidity will be under pressure. As my colleague Paul Summers pointed out, the airline still has to pay its fixed costs, including interest. Doing so is quite tricky while it doesn’t get any sales revenue. However, IAG’s liquidity cushion of about €10bn does inspire some hope and would allow the company to exist for some time. Still, IAG will probably be forced to borrow substantial sums of money until the situation for the industry gets substantially better. This, in turn, will make the company more of a risk in the short term.

The reason why Moody’s did not cut the airline’s credit rating further is because of its size and reputation. So, as soon as the situation for the industry improves, the company will probably be the first to benefit from it.

This is what I’d do

Even though I like being a bargain hunter, buying IAG’s shares now is, in my view, too much of a risk. I think it will take the airline industry too much time to recover. So, I’d prefer to invest in more stable and profitable companies.