Companies like Carnival Corporation (LSE:CCL) look ridiculously cheap right now. Still, I consider buying Carnival’s shares to be too risky. Here’s why I’d prefer to buy other FTSE 100 shares.

Carnival Corporation shares

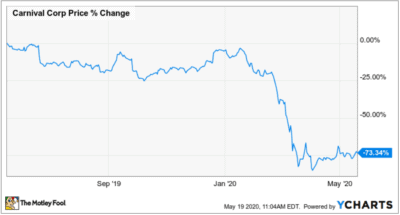

First, it is absolutely true that the company’s stock looks like a bargain after having fallen more than 73% from a year high. That’s why Saudi Arabia’s sovereign wealth fund bought a stake in the cruise operator.

The cruise operator’s financial position

Nevertheless, the company’s shares are cheap for a very good reason. Carnival reported a net loss of $781m for the first quarter of 2020 compared to a net profit of $336m for the first quarter of 2019. This was not just because of cancelled voyages. It was mainly due to asset depreciation and reputational damages. Things could have been worse for the cruise operator. Reputational and asset depreciation losses don’t lead to cash outflows.

However, it was quite unpleasant for the shareholders to hear that Carnival Corporation suspended its dividends and share buyback programme. The company was also forced to issue plenty of debt and equity to finance its operations. As my colleague Harvey Jones pointed out, this financing might be enough for the cruise operator to survive until November.

Still, the most worrying sign for investors is the fact that the company reported these losses on the 19 March. The next earnings release date will be the 18 June. I think that there will be many more negative news items to come. So, the share price will be under pressure.

There is also a risk that the coronavirus pandemic will not be over by autumn. In this case, the cruise operator might go bankrupt.

Even though Carnival Corporation is the leader in the industry and the pandemic might be over fairly soon, the company is not a good fit for defensive FTSE 100 investors right now.

However, brave long-term Footsie stock pickers willing to take additional risks might end up making the best buy in their lives if they invest in Carnival’s shares. It looks to me that it is a typical high-risk, high-reward investment.

FTSE 100 companies worth buying

Established pharmaceutical companies like GlaxoSmithKline continue to make a profit during this downturn. It is not just a matter of who will be the first to develop the Covid-19 vaccine. It is also about producing and selling medical goods that help to combat the coronavirus symptoms. Glaxo enjoys an investment-grade credit rating, issued by Moody’s and S&P. Even though its shares don’t look extremely cheap, they are still well below their January highs.

Another investment idea in this time of uncertainty seems to be Tesco. It is not a rock star in terms of efficiency, and its net profit margin is only 1.44%, which is quite low. Still, it can compete in terms of sales revenue since it is the biggest retailer in the UK. The important thing is that it sells groceries and other necessities. Consumers don’t cut spending on things like this even during recessions.

Conclusion

It is up to every investor to decide how much risk to take. But I’d prefer to buy companies that do not currently struggle and park some of my £5,000 into companies like Tesco and GlaxoSmithKline. And there are other attractive alternatives for FTSE 100 investors.