Investing during a stock market crash to improve your financial position isn’t easy. It’s sometimes difficult to tell between a good company selling at a bargain price and a not-so-good company trading at a superficially cheap price. Every so often it can help you to look at what the professionals are doing. It can also help you to look away from the biggest firms to the broader options of the FTSE 250 index.

Asset management firm JP Morgan is one professional investor that has looked away from the FTSE 100. It has taken advantage of the lower prices resulting from the stock market crash and analysed the new values of many FTSE 250 companies. Renowned for discovering potential profitable opportunities for investment, JPM has recently bought a 5% stake in bus operator National Express (LSE: NEX).

So what does the top-tier investment bank like about the firm?

Impressive revenues prior to the crash

National Express reported revenue growth of 9% for Q1 to March. And prior to the coronavirus-induced stock market crash, it was on track for 17% growth.

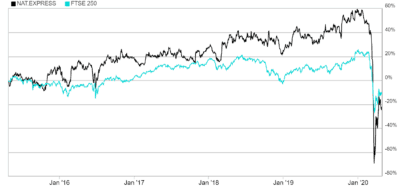

I think this is impressive and shows how far the firm has come from its more troubled days of 2008/09. Indeed, this journey is reflected in its steadily climbing share price. Over the last five years it outperformed the FTSE 250 before the recent plunge.

Before the stock market crash, National Express was in very good shape and efficiency savings had made a noticeable difference to the firm’s operating margins, which are now over 8%.

The company has been taking every opportunity to transform itself from a UK-focused business. Up to 75% of its revenues now come from outside the UK, with 45% from North America and 30% from Europe and North Africa. Like many leading FTSE 250 firms, it’s sales base is highly diversified and its business model profitable. 2019 showed a return on capital employed ratio of 9.58. Although still below the industry average of 13, it’s growing and demonstrates improving use of capital.

The company reassured shareholders recently too. It issued a Covid-19 update saying a great many of its contracts are being honoured and government support was available. Its shares rebounded in response

Year-on-year dividend growth

Sadly, the stock market crash meant that the firm cancelled the April 2020 dividend, in line with many of its FTSE 250 peers. However, prior to this, National Express has produced dividend growth year-on-year for at least the previous half decade. And it had dividend cover of 2 in 2019.

Following the share price crash, National Express currently offers a potential dividend yield of 6.86%. The shares are trading around 233p, and it has a price-to-earnings (P/E) rating of around 8. It’s trading much lower than the fair value many analysts attributed to the FTSE 250 firm prior to the stock market crash. This was around 433p and may suggest National Express is currently undervalued.

It’s easy to see why National Express caught the eye of JP Morgan. I think it’s a great stock to add to a diversified portfolio that could provide you with future value.