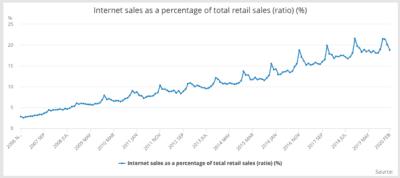

When it comes to powerful investment themes, it’s hard to look past the growth of e-commerce. In the UK, the percentage of overall retail sales represented by online sales has skyrocketed from approximately 6.5% to around 20% over the last decade.

And looking ahead, the trend is expected to continue. According to industry experts, internet sales could account for over 50% of total UK retail sales by as early as 2028.

For investors, the growth of online shopping is likely to present many opportunities in the years ahead. With that in mind, here’s a look at some UK online shopping stocks that could help you gain exposure to this growth story.

Source: ONS

Online shopping stocks: pure online retailers

If you’re looking for online shopping stocks, the best place to start is generally pure online retailers. These are companies that only sell goods online. Many of the world’s largest pure online retailers such as Amazon and eBay are listed in the US. However, there are still plenty of opportunities for investors here in the UK.

One example is Ocado. It’s an online supermarket that describes itself as the ‘world’s largest dedicated online grocery retailer.’ It also specialises in helping other supermarkets with warehouse automation.

There’s also ASOS and Boohoo, which specialise in online fashion. These companies, which sell a massive variety of clothing online, have both registered prolific revenue growth over the last five years.

Additionally, there are niche online retailers. One example is Gear4music, which sells musical instruments online. It’s another company that has grown rapidly over the last few years.

Retailers that sell online

‘Omnichannel’ retailers that sell a proportion of their goods online could also potentially be worth considering. One that has seen solid growth in online sales recently is JD Sports Fashion, which mainly sells trainers and athleisure clothing. Major supermarkets such as Tesco and Sainsbury’s (which owns Argos) have also experienced strong online growth in recent years.

Warehouse and logistics companies

Retailers are not the only online shopping stocks you can invest in, however. The e-commerce industry is made up of many different subsectors, meaning there are plenty of other ways to get exposure to the theme.

One area that could be worth considering is warehouse and logistics companies. These types of companies appear well placed to benefit from the online shopping boom. Examples include the likes of SEGRO and Tritax Big Box REIT, which are both warehouse-focused real estate investment trusts. Then there’s logistics specialist Clipper Logistics. Its customers include the likes of ASOS and Joules.

Packaging companies

Packaging companies can also offer exposure to the theme. One good example is DS Smith. It manufactures the types of cardboard boxes that Amazon deliveries come in. Other companies in this sector include Mondi and Smurfit Kappa.

Technology-focused online shopping stocks

Finally, there are plenty of niche technology companies that could help investors capitalise on the growth of online shopping. For example, one stock I like is GB Group, which provides identity management technology. Its customers include ASOS and Nordstrom. DotDigital is another interesting play. It specialises in email marketing software.

Overall, there are many different online shopping stocks listed in the UK. The key, as always, is to diversify your capital across a few holdings in order to give yourself the best chance of profiting from the theme.