The investing landscape is becoming more and more perilous for dividend seekers.

Firms of all shapes and sizes are axing dividends like there’s no tomorrow. Irrespective of the segments in which they operate, and thus how badly affected they will be likely hit by the coronavirus outbreak, dividends are toppling like dominos as fears over future profits mount. Even firms with robust balance sheets are taking the decision to stop payouts to conserve cash.

Dividends are on the slide

The extent of the dividend cutting was underlined by Link Group figures released today. These show that an eye-popping 45% of companies have already brought the blade down on shareholder rewards. This amounts to a whopping £25.4bn worth of dividends between now and the end of 2020, it estimates. Payments worth an aggregated £17.5bn have already been paid in the first quarter.

To put this decline into context, the financial data provider comments that “this represents one third of the dividends [we] had expected UK plc to pay over the rest of this year before the Covid-19 crisis struck.”

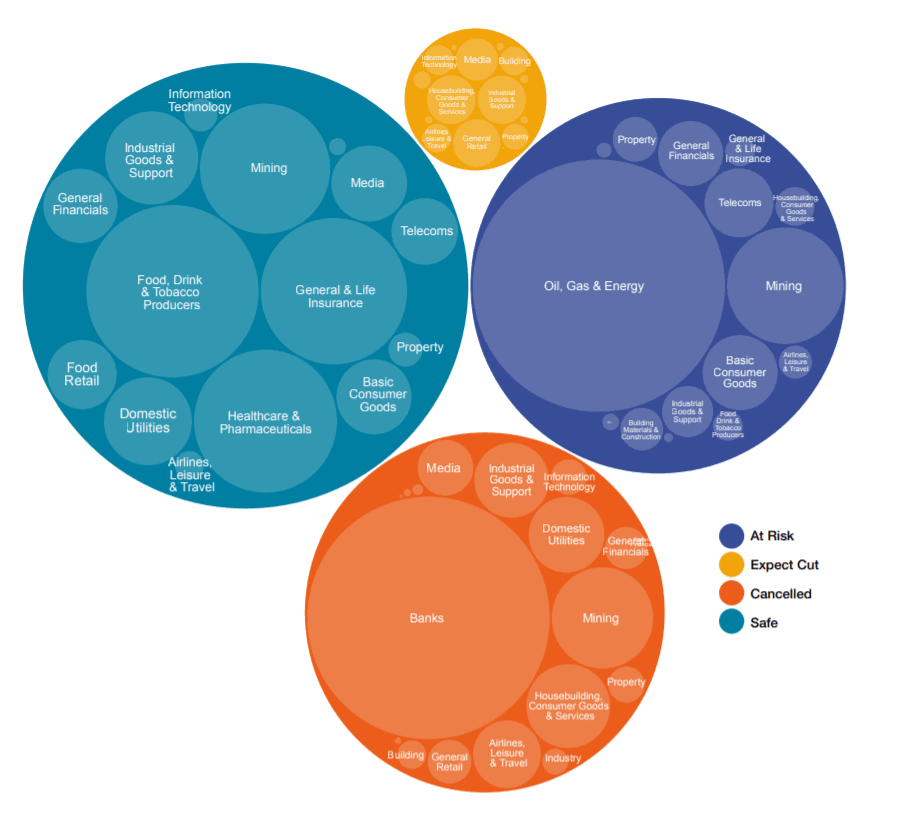

With the coronavirus outbreak far from beaten, it is clear that investors should be prepared for more dividend cutting in the months ahead. Link Group estimates that a further £23.9bn worth of rewards could be at risk for this year. It considers a total of just £31.1bn to be safe.

Cuts are coming

Whatever happens from now on, it looks as if annual dividends will fall off a cliff in 2020. Under its most realistic ‘best case’ scenario, Link Group anticipates that total dividends this year will fall 32% from 2019 levels to £67.3bn. This assumes that oil companies will pay out in full but that half of the firms in the ‘At Risk’ group (see chart) will cancel payments.

Meanwhile, according to its most realistic ‘worst case’ playbook, Link Group says that half of the ‘At Risk’ dividends will topple along with those from oil producers. Energy accounts for half of all the group’s dividends, though Link Group notes that a full cancellation of payouts is highly unlikely.

Under this scenario, total dividends would plummet 39% year on year to £60bn.

Yields are dropping

So what does this mean for yields? Well under Link Group’s ‘best case’ scenario, the reading for the next 12 months comes out at 3.9%. As the firm notes, this is still above the 30-year average figure of 3.5%.

Things look much scarier under the ‘worst case’ synopsis, though. Under these circumstances the yield would sit at just 2%, a low not plumbed since the depths of the dotcom crisis two decades ago.

These are unprecedented times, at least from a modern perspective. It means that share pickers need to be extra careful when it comes to filling their shares portfolio. But the worst thing investors can do is to pull up the drawbridge entirely. With the right guidance it is still possible to make big returns from share markets. And there’s plenty of brilliant bargains out there following the recent sell-off.