Fundsmith Equity and Lindsell Train Global Equity are two of the most popular investment funds in the UK. Due to their amazing returns – Fundsmith has returned roughly 134% over the last five years while Lindsell Train has returned around 147% versus 32% for a FTSE 100 tracker – both have topped fund platforms’ bestsellers lists for years now.

The thing is though, the two have very similar investment styles. Not only are both global equity products, but the fund managers of each, Terry Smith and Nick Train, are both very much ‘quality’ investors. This means that both funds are focused on large, well-established companies that are highly profitable, but aren’t necessarily cheap.

With that in mind, is it sensible to hold both in your portfolio or are you better off picking just one?

Holdings analysis

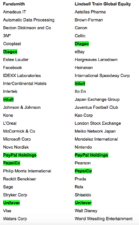

To answer that question, it’s worth looking at the holdings of each fund. Below, I’ve put together lists of the full holdings for each one at 30 June using their half-year reports. For Fundsmith, I used the SICAV half-year report.

* 3M has since been replaced with Brown-Forman, which Lindsell Train also owns.

Looking at these holdings, the two are certainly quite different in their composition. At 30 June, there were only five stocks (in green) that were held in both portfolios.

What this means is that by owning both funds, instead of just one, you could actually lower your stock-specific risk quite substantially. For example, instead of owning just 27 high-quality stocks though Fundsmith, you could potentially own nearly 50 high-quality stocks if you split your capital across both of them.

It’s also worth noting that the geographic allocations of the two funds are very different. For example, Lindsell Train currently has over 20% of the fund allocated to Japan whereas Fundsmith has zero exposure to Japanese companies.

So, looking at the holdings, I don’t think it’s a problem to own both. Ultimately, if you own both, instead of just one, your portfolio will be better diversified from both a company and a geographic perspective.

Be mindful of your quality exposure

One thing I would be a little bit careful with, though, is overall exposure to this style of investing. Now, don’t get me wrong, I’m a big fan of quality investing. After all, it has worked wonders for Warren Buffett over the years. Yet I do think it’s sensible to diversify the investment styles within your portfolio a little, in the same way that you’d diversify your stock holdings.

The quality investing style has certainly worked well over the last decade. But, as always in investing, there’s no guarantee it will keep delivering such fantastic returns in the future. If value investing or small-cap investing strategies were to come back into focus, expensive quality stocks could underperform (we’ve seen a little bit of this recently).

So, if you do want to own both Fundsmith and Lindsell Train Global Equity, it’s probably sensible to combine them with some other funds that have different styles, so that you’re not overly exposed to one specific strategy.

In conclusion, I don’t see anything wrong with owning both funds. I own both myself. Just remember, there’s no guarantee that quality investing will continue to outperform so, from a risk-management perspective, it’s sensible to diversify your investment styles.