Most stock indexes around the world are two digits above ground so far this year, but investors are still to recover from the Christmas downhill racing that caught them unprepared and that blew out 2018 performance.

One little-known fact about UK equities is that they’re in bear market territory, if we take the FTSE 250 as a benchmark. The mid-cap index rose 14% since bottoming on 27 December, but the accumulated decline between 14 June and that date has been exactly 20%, which defines a bear market. While a decline like this doesn’t necessarily mean we’re heading towards recession, the increase in volatility is a warning sign. If nothing else, it’s time to look for safer equities.

Tilting portfolios towards changing conditions

One simple way to prepare for a downturn is to sell all stocks in our portfolio, but that isn’t wise, because we don’t know the exact timing and dimension of a potential deceleration. There are many ifs, as this is just a probabilistic scenario.

We can do much better, if selecting stocks that are stronger on the factors that are expected to prevail under a deceleration scenario: value, quality and low volatility. When growth decelerates and volatility increases, cheaper and financially sound stocks (with less uncertainty surrounding them) tend to outperform the market.

How can we capture those features?

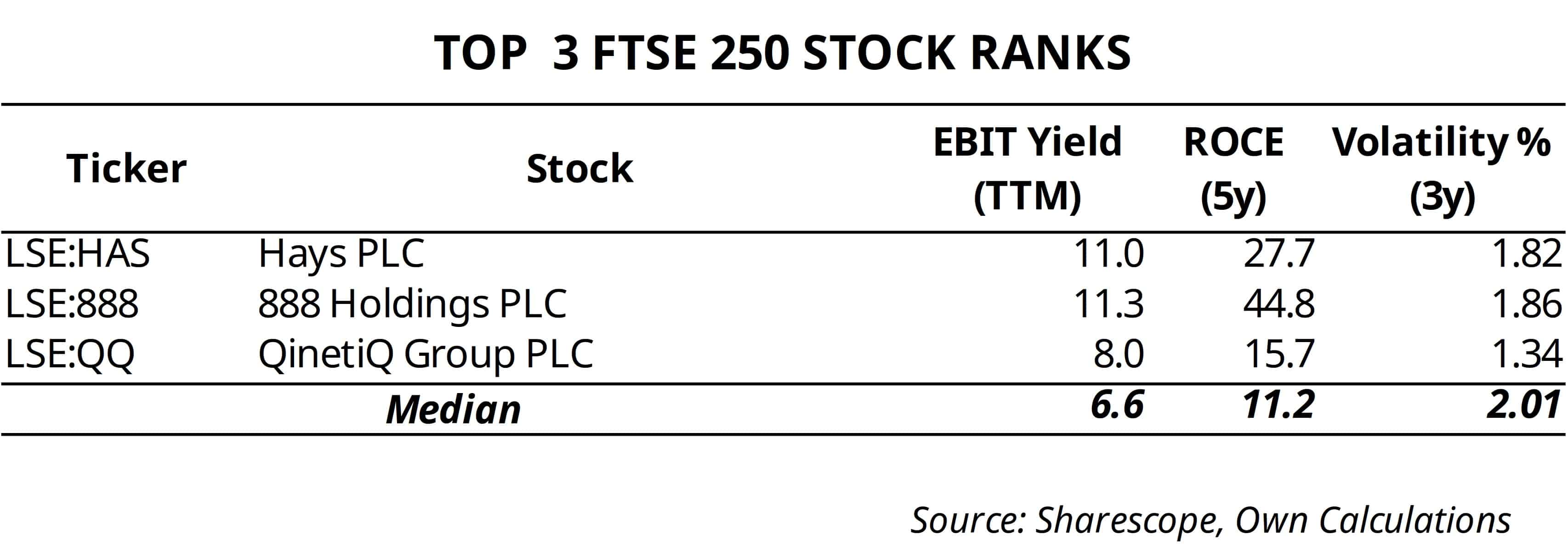

We need proxies for the factors. I’ll be using earnings before interest and taxes (EBIT) yield to capture value, as I believe it’s more reliable than the P/E ratio. I’ll be using the return on capital employed (ROCE) ratio to capture quality, as it tells how well a company employs money into the business. Finally, I’ll compute the standard deviation of returns to use as proxy for low volatility.

The short list

With the proxies selected, it’s time to screen stocks and rank them, from best to worst, using one ratio at a time. The higher the EBIT yield, the higher the ROCE, and the lower the standard deviation, the better. Because I prefer stocks ranking high on the three factors at the same time, I use an average rank, computed from the three ratios. For my universe of assets I selected the FTSE 250 to exclude the 100 largest capitalisations that are supposedly more exposed to Brexit. I also excluded financials and utilities from the list.

The top spot is taken by Hays. The staffer and recruitment agency ranks in the top 30 by EBIT yield and top 10 by ROCE, while showing less volatility than average. The second spot is taken by 888 Holdings. The resort and casino company that largely provides gaming entertainment ranks very similarly to Hays, offering good protection for any downsize as its EBIT yield is the highest of the three stocks. Finally, QinetiQ Group offers the best protection against rougher market conditions, as it ranks in the top 5 by volatility.