When starting an investment portfolio, it makes sense from a risk perspective to invest in a fund. If you only have £1,000 or so to invest, it’s not really economical to buy a whole portfolio of shares. Trading commissions will take a huge chunk of your capital. Buying a fund is an efficient and cost-effective way to spread your capital out over many different companies, reducing the risk to your portfolio.

In a recent article, I examined three types of funds that are popular among both beginner investors and experienced investors alike. These included mutual funds, investment trusts and exchange-traded funds (ETFs).

Today, I’m looking at two ETFs that I would definitely consider buying if I was investing my first £1,000 now.

Vanguard FTSE 100 Index Unit Trust

A portfolio of blue-chip companies is a good foundation for any portfolio. With that in mind, if I was investing my first £1,000 today I would consider investing in the Vanguard FTSE 100 Index Unit Trust (LSE: VUKE). This ETF can be bought and sold just like a regular stock under the VUKE ticker.

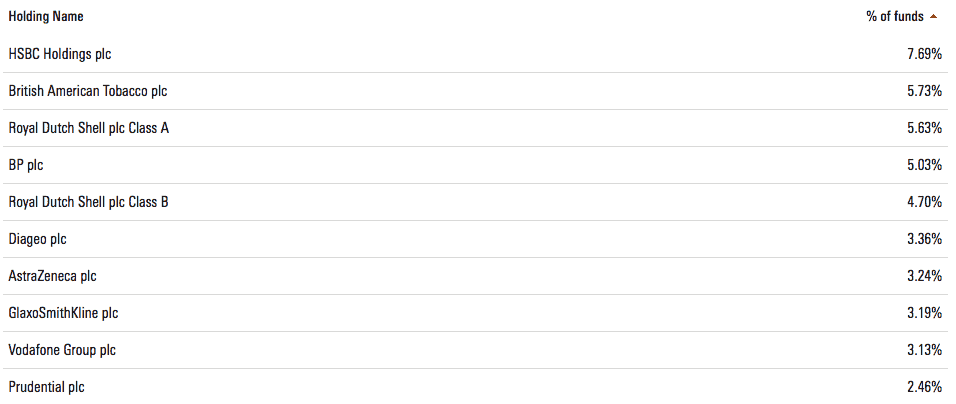

Vanguard is a highly regarded ETF provider. This particular fund attempts to track the performance of the FTSE 100 index, the UK’s main stock index. That means an investor will gain exposure to the some of the largest companies listed in Britain, many of which are well known across the world. The top 10 holdings of the index are shown below:

Source: Vanguard, data as of 29 December 2017

Fees are low, with the ongoing charge just 0.06%. I would probably invest £500 of my first £1,000 in this fund to gain exposure to the largest companies listed on the London Stock Exchange.

Vanguard FTSE 250 UCITS ETF

Once I had my core holding of blue-chip shares sorted with the FTSE 100 ETF listed above, I’d also be interested in getting some exposure to mid-cap stocks. These are companies that are slightly smaller companies, yet are often growing at a faster pace. This means that they may offer the potential for larger investment returns.

To get exposure to mid-caps, the FTSE 250 index is a good place to start. This index contains the largest 250 stocks in the UK after the largest 100 companies. It’s performed very well over the long term. For example, for the five years to the end of 2017, the FTSE 250 provided a total return 92%. This easily eclipsed the 57% return of the FTSE 100.

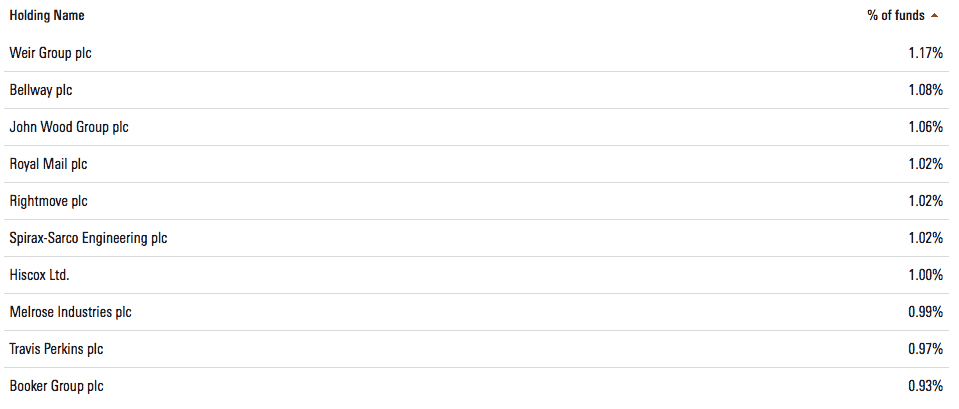

Vanguard also has an ETF tracking this index. It’s the Vanguard FTSE 250 UCITS ETF (LSE: VMID). The top 10 holdings are listed below. It includes household names such as Royal Mail, Rightmove and Travis Perkins.

Source: Vanguard, data as of 29 December 2017

The ongoing charge here is just 0.1%. I’d invest the remaining £500 of my £1,000 in this ETF to add a little more growth exposure to my portfolio.