There isn’t a lot of overlap between stocks that pay a very nice dividend and can also appeal to investors looking for double-digit growth and huge capital appreciation prospects, but that doesn’t mean they don’t exist. In fact, I think one such stock that fits the criteria and is flying under the radar of many investors is off-licence operator Conviviality Retail (LSE: CVR).

Over the past two years the company has recorded year-on-year (y/y) earnings increases of 22% and 49% and its share price has risen over 75% in just the past year. Yet despite this rapid share price growth the company still kicks off a very attractive 3.2% annual dividend yield.

The key to success on each of these fronts has been acquiring rivals, reorganising back office functions and steady like-for-like (LFL) growth due to changing consumer habits. On the acquisition front Conviviality has made two large acquisitions in recent years that have made it the UK’s largest independent wholesaler of alcohol to on-trade customers such as pubs, restaurants and hotels.

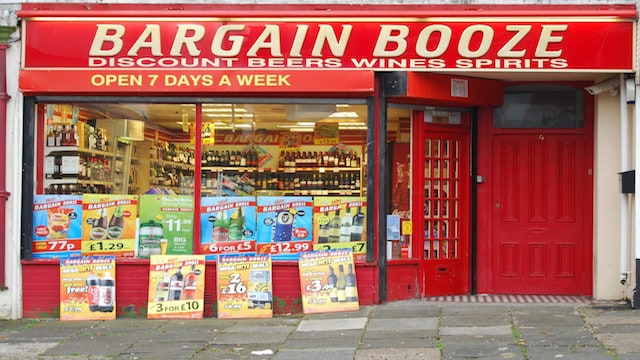

This has given the group greater pricing power and also cut overlapping costs, which has led to higher margins and cash flow. In addition to growth in the wholesale trade, the group’s owned and franchised off-licences like Bargain Booze have been performing very well due to consumers increasingly shopping at small, local outlets rather than out-of-town big-box stores. In the year to April these two divisions posted underlying acquisition-adjusted y/y sales increases of 6.4% and 6.1% respectively.

Including the positive effects of acquisitions, the group’s revenue for the year rose 85% y/y to £1,560m while improved margins led to EBITDA more than doubling to £60.9m. And with net debt of just £95.7m at year-end and free cashflow quadrupling, management was able to increase full-year dividends by 33% to 12.6p.

Looking ahead, the positive benefits of increased scale should allow Conviviality to increase the number of items it offers to wholesale customers, improve its bargaining power with suppliers and customers alike and expand into new markets. While the company’s shares are looking a little pricey at 17.2 times forward earnings, Conviviality is one dividend growth star I’m definitely interested in.

A small-cap turnaround opportunity

A smaller and riskier option that could also appeal to both types of investors is £50m market cap European patent attorney Murgitroyd (LSE: MUR), which offers a 3.2% yield and has recently returned to earnings growth.

The company was hit in H1 by falling profits due to complications from an acquisition that resulted in significant increases in business development and IT costs. However, the group believes these will be one-offs and the fact that H2 saw the company return to year-on-year pre-tax profit growth suggests this may be the case, although it’s still too early to be completely certain.

Over the medium term, the group’s growth prospects appear quite appealing as it expands the number of services offered to corporate customers filing EU patent applications. Furthermore, with both the European Patent Office and EU Intellectual Property Office seeing respectable single-digit growth in the absolute number of applications in 2016, Murgitroyd is benefitting from steady overall market growth.

With profitable operations, cash on hand, its shares valued at 16 times forward earnings and well-covered dividend payouts, I believe Murgitroyd could prove an interesting dividend growth stock if it can sort out its internal issues.