It’s always worth keeping a watch on companies that have recently come to the market. So long as the investment case is solid, those who buy shares early on can often enjoy quick capital gains.

One recent example is colour cosmetics business Warpaint London (LSE: W7L). Since arriving on AIM back in November, shares in the Buckinghamshire-based company have jumped from its IPO price of 97p to 165p. A 70% return in just over three months? Now that’s a company I want to learn more about.

Looking good

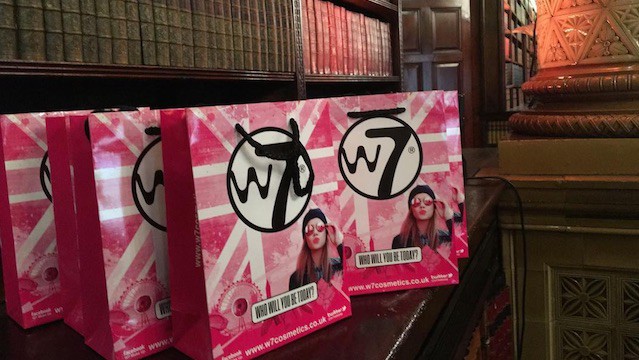

Warpaint London focuses on offering consumers in the 16-30 age range “high quality cosmetics at affordable prices“. With more than 500 items, its flagship W7 brand is sold to high street retailers and independent beauty shops in over 40 countries. In addition to this, Warpaint also operates a close-out division which buys excess stock of branded cosmetics such as Max Factor before selling them on to discounters.

Although new to the stock market, a quick glance at its financial history suggests this could be a stock to buy and hold for the medium-to-long term. Annual returns on capital over the three-year period from 2013-15 were all around the 50% mark. Take into account the company’s net cash position and the fact that sales of lipstick and eyeliner will continue regardless of the macroeconomic picture and things start looking pretty attractive.

Another point worth mentioning is Warpaint’s relatively low free float. At the time of writing, only 36% of the company’s 65m shares are available to investors. The remainder are held by the company’s board, with joint CEOs Samuel Banzini and Eoin Macleod owning a combined 63% stake. In addition to guaranteeing that both will be highly motivated in pushing the business forward, you can also be sure that this limited availability will mean that any positive news (such as the introduction of a dividend) could lead to a significant jump in the share price.

Shares in Warpaint trade on a not-unreasonable 17 times earnings for 2017. What’s more interesting however, is that the price-to-earnings growth (PEG) ratio is only 0.7. As a general rule of thumb, anything less than one on this metric is indicative of a company offering excellent value for money given management’s plans for expansion.

Things to be wary of? Even those with meagre knowledge of the products will recognise the highly competitive nature of the cosmetics market. Warpaint’s dependence on two highly-motivated CEOs to drive the company forward could also backfire if one or both ever decide to leave.

Bog standard profits

If adding Warpaint to your portfolio doesn’t appeal but you remain interested in small companies selling products that people buy on a regular basis, shares in Accrol Group (LSE: ACRL) might be a viable alternative.

Based in Blackburn, the £135m cap manufactures toilet rolls, kitchen rolls and facial wipes. It’s hardly exciting stuff but then some of the best investments never are. Since coming to the market last June, shares in the owner of brands such as Sofcell and Thirsty Bubbles have put in a very encouraging performance, rising 29% to 142p.

Trading on 11 times earnings for this year, reducing to 10 in 2018 so long as earnings growth estimates of 10% are hit, stock in Accrol still doesn’t look expensive. Like Warpaint, Accrol also has a low PEG ratio of just one for 2017.