The Croda International (LSE:CRDA) share price has fallen by 33% over the last year. This has been the result of weak sales as the firm’s customers work their way through unusually high inventories.

That can’t go on forever, though. And with revenues up 8% sequentially during the first three months of 2024, is it time for shares in the FTSE 100 chemicals company to bounce back?

A bit of context

First things first – a bit of background. Croda sells speciality chemicals that are used in the consumer care, life sciences, and industrial industries.

The most important of these are consumer care and life sciences, which account for 58% and 30% of total revenues respectively. And both divisions have been struggling lately.

This is due to Croda’s customers stockpiling its products during the pandemic, causing demand to jump. Since then, they have been working through those supplies, resulting in lower demand.

There are huge barriers to entry for competitors, which means the company is likely to do well when demand recovers. But the real question for investors is when that’s going to happen.

Revenues and profits

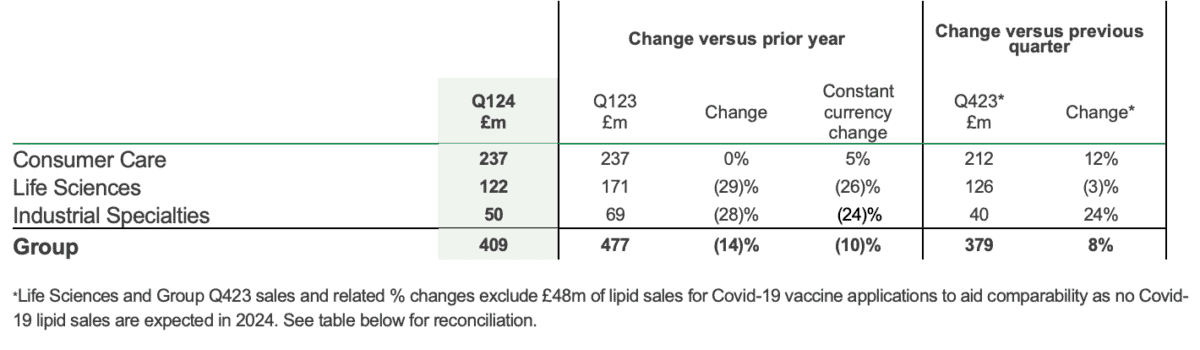

Croda’s latest trading update takes some interpreting. Taken at face value, the company’s sales for the first quarter of 2024 came in 4% lower than the last three months of 2023.

That looks like an indication things are getting worse, but that doesn’t account for £48m in Covid-19 sales during the last quarter of 2023. Leaving those one-off sales aside, things look a bit brighter.

Croda International Q1 Sales Report

Soure: Croda International Investor Relations

While demand in the life sciences division remained subdued, Croda’s consumer care sales grew by 12%. That meant total revenues increased by 8%., excluding Covid-19 lipid sales.

As a result, management reiterated its expectation that pre-tax profits would be somewhere between £260m and £300m in 2024. With a market cap of £6.6bn, that implies a return of around 4%.

Is the stock too cheap to ignore?

Croda is a great example of a company with terrific long-term attributes that is dealing with short-term issues. These situations can be great opportunities for investors.

Even in these situations, though, it’s important for investors to be cautious about the risk of overpaying. The fact that a stock is down doesn’t automatically make it a bargain.

In the case of Croda, the entire company has a market value of £6.6bn. And in 2021 – the company’s best year to date – it managed £181m in free cash flow.

That implies a return of just under 3%. With interest rates currently above 5%, this makes it difficult to think the stock is materially undervalued at the moment, even after its latest decline.

Quality

As I see it, the investment case for Croda International rests on the idea that this is an extremely high-quality business in an unusually difficult situation. And I agree with this.

I also think the high inventory levels that have been weighing on the company’s sales won’t last forever. But despite the recent decline, I’d like to see this at a lower price before I start buying it.